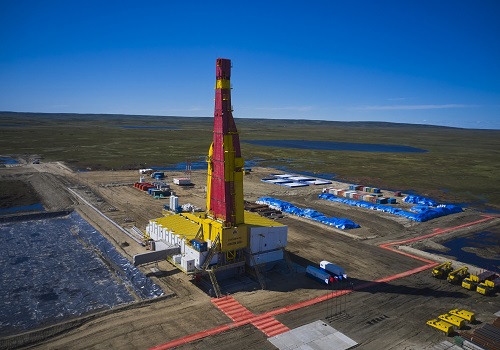

Rosneft starts production drilling at Payakhskoye field of Vostok Oil project

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Rosneft has started production drilling at the Payakhskoye field on the Taimyr Peninsula. The Russian energy company plans to drill about 80 wells there by the end of this year.

The Payakhskoye field is part of Rosneft's Vostok Oil strategic project. Its licence fund consists of 52 subsoil plots, within which 13 fields have been discovered, four of which have already been put into development using the latest technologies.

The project's resource base of 6.2 billion tonnes of oil has been confirmed by extensive exploration work, detailed reports by world-class experts and international auditors.

These resources are comparable to the largest oil provinces in the Middle East or the US shale formations and are also commensurate with another legendary Russian field, the Samotlor field in the Khanty-Mansi Autonomous Region (7.1 billion tonnes).

The development of the Samotlor field allowed the Soviet Union to become one of the leaders in the international hydrocarbon market. But the era of this West Siberian oil province is coming to an end, while the era of the Taimyr is just beginning. According to Rosneft's plan, production at the project will reach 115 million tonnes by 2033.

With the decline in investment in oil and gas that the world has seen over the past few years, Vostok Oil is the only project capable of having a stabilising effect on hydrocarbon markets.

Over the past five years alone, total upstream capital expenditure by the largest energy companies has fallen by 29 per cent, and total investment in the oil and gas industry has fallen by 26 per cent over the past decade. At the same time, according to JP Morgan, global energy demand is set to outpace supply by 20 per cent as emerging economies grow rapidly and work to improve living standards and quality of life. To eliminate the deficit in oil alone by 2030, the world needs an additional investment of $400 billion. Against the backdrop of reduced investment, analysts predict that this level is unlikely to be achieved, and the oil deficit may persist for a long time.

The fact that Rosneft is launching a major energy project amid increasing external economic pressure shows the enormous sustainability of both the project and the company as a whole.

The unique, sustainable economic model of Vostok Oil is an essential factor contributing to the project's investment attractiveness. Rosneft has already received opinions from leading international experts confirming the project's resource base, development technologies, and economics. Major international investment banks highly value Vostok Oil: JPMorgan - $114 billion, Raiffeisen - $90 billion, Citi - $86 billion, Goldman Sachs - $85 billion, Bank of America - $70 billion.

The perimeter of the project includes a whole complex of oil transport, airport and energy infrastructure, including the country's largest oil transhipment terminal on the Northern Sea Route with a capacity of 100 million tonnes per year, 7,000 km of pipelines, 3.5 GW of new capacity, helipads, etc.

Rosneft has already started the construction of the unique port Bukhta Sever in the Yenisei Bay in the west of the Taimyr Peninsula. The port infrastructure includes three cargo and two oil loading berths with a total length of almost 1.3 km, Russia's largest receiving and loading station with 27 reservoirs of 30,000 cubic meters each, and technological and auxiliary infrastructure facilities.

The oil loading terminal in the Bukhta Sever is a strategically important facility, providing oil transhipment from the fields of Vostok Oil via the Northern Sea Route. It will become Russia's largest oil loading terminal with an oil receiving and storage fleet. By 2030, it will have 102 tanks.

Supplying raw materials from the fields to all international markets, especially the Asia-Pacific region, is a logistical advantage of the Vostok Oil project.

Oil will be supplied to the Bukhta Sever port via the pipeline system under construction from the fields of the Payakh and Vankor clusters. The total length of the trunk oil pipelines will be about 770 km. Using the infrastructure of the first phase, the volume of oil transhipment through the sea terminal of the port Bukhta Sever can reach 30 million tonnes per year, with subsequent gradual reaching a total transhipment volume of 100 million tonnes in 2030.

Own pipelines and port will allow to maintain the marketable characteristics of oil produced under Vostok Oil. This oil is characterised by unique premium qualities with extremely low sulfur content from 0.01 to 0.04 per cent and low density.

For comparison, Brent has 0.45 per cent, WTI 0.45 per cent, Urals 1.5 per cent, ESPO 0.5 per cent, Siberian Light 0.6 per cent, and Eagle Ford (Texas) has 0.2 per cent.

Vostok Oil's low unit production costs and minimal carbon footprint, which is 75% lower than other major projects, make it today the most environmentally friendly, "green" hydrocarbon production project.

"The project includes wind power to maximise the transition to clean energy consumption with zero greenhouse gas emissions," Vostok Oil General Director Vladimir Chernov said.

"It is too early to talk about the planned capacity of wind power plants (WPPs). The final decision will be made after a study of the wind energy potential of the territory. But it is already clear that the maximum capacity of wind power plants can reach 200 MW. China's leading wind energy companies are considered potential partners," Chernov said.

In November 2021, Rosneft reported that it had signed cooperation agreements with several Chinese companies to study the wind energy potential of the project.

Vladimir Chernov said the project would also provide 9 to 12 gas turbine power plants with 300 MW to 1 GW capacity. "We are considering building a power system where the power plants will be staged with associated petroleum gas nearby," he specified.

The company reported that Vostok Oil would use 99 per cent of its associated petroleum gas to power its power stations, one of Russia's highest associated petroleum gas utilisation rates.

The project fields now consume about 400 MW of electricity. The Vankor power station alone, with a capacity of about 200 MW, covers these needs so far. It was connected to the Unified Energy System of Russia in 2015. The second one is the Polar power station, with a capacity of 150 MW, which will be launched under the project in December. The construction of the third, Irkinsk power station, with a total capacity of up to 850 MW, is scheduled to start operating in winter, Chernov said. Vostok Oil will build about 3.5 GW of new capacity and about 7,000 km of transmission lines. Vostok Oil's power facilities are an example of successful import substitution: over 99% of the equipment and components are Russian-made.

The Vostok Oil project is producing at full capacity at the Vankor cluster. "Rosneft is developing the project jointly with Indian companies. Since 2016, 49.9 per cent of Vankorneft has been owned by a consortium of ONGC Videsh, Oil India Limited, Indian Oil Corporation and Bharat Petroleum. Thanks to the successful development of the Vankor cluster and the vast experience accumulated while working there, the Vostok Oil project is proceeding as planned.

The Vostok Oil project will employ up to 400,000 people and create more than 100,000 jobs during the operational phase in the fields and nearby settlements.

A total of 15 field camps and two airfields are planned to be built for the Vostok Oil project. All facilities will be self-powered by associated petroleum gas.

At this year's Economic Forum in St Petersburg, Rosneft CEO Igor Sechin demonstrated the audience a flask of oil produced under Vostok Oil as proof that the project has been successfully implemented. He called Vostok Oil the "Noah's Ark of the world economy".

"Russia, with its energy potential and portfolio of first-class projects, such as Vostok Oil, can meet the world's long-term needs for affordable energy resources and certainly is such saving Ark," Sechin said.

According to him, implementation of the project is vital to balancing the global energy market, which is already beginning to face acute shortages of raw materials.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">