Rollover Analysis April-21-Extreme price swings between the trading band - Yes Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Extreme price swings between the trading band

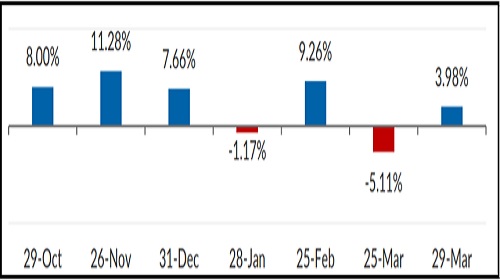

High end price volatility seen for Indian markets in past couple of days, as Nifty settled the penultimate day for April series at 14895 levels marking high above 15k on expiry day. Highlights for the April series were a) After heavy shorting in first half Banking stocks saw sharp reversal in fag end of April expiry as BankNifty ended with 2% gains eoe with ~6% gains in last week of expiry b) Hint of short covering on index futures positions from FII’s added to positive traction c) Traders remained on edge as worrisome India’s COVID situation d) Bank Nifty saw sharp reduction in OI base compared to previous month expiry data down to 14lacs shrs rolled from 29lacs shrs

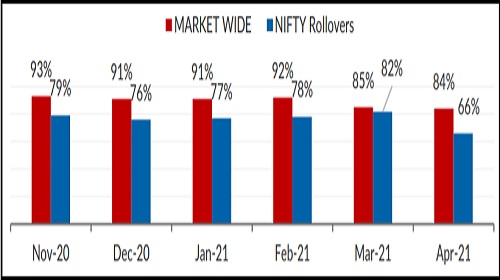

Rollovers for Nifty/Bank‐Nifty stood at 66% (1.02lacs shrs)/65% (13.9lakh shrs) vs 82% (98lacs shrs)/88% (29lakh shrs) previous month, low rollover on Bank Nifty were accompanied by sharp unwinding on aggregate OI base. Market wide rolls stood at 84%vs 85% previous month while the decline continues to 6 months avg. of ~90%.

FII’s derivative stats, index futures long rolls declined in absolute terms it stood at 77% vs 3month avg. of 86% while index futures short rolls stood at 43% vs 55% on 3month avg. May series starts with index futures long to short ratio of 3.56x vs 3month avg. of ~2.1x at start of series. On options front, Max. call/put OI on Nifty for May monthly series stands at 15k calls (OI 2mn) and 14k put (OI ~2.9mn) shares. We expect wild swings to continue, with formidable support now emerges at 14200 mark.

Exhibit 1: Sector‐wise rollovers

Exhibit 2: Market vs Nifty Rollover

Exhibit 3: Nifty Expiry to Expiry Change

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

Above views are of the author and not of the website kindly read disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Nifty is expected to open on a flattish note and likely to witness range bound move during t...