Rise in Premium amount for Life Insurance is the biggest concern for consumers - Hansa Research`s CuES 2023 Report

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Hansa Research has recently released its much-awaited annual syndicated report, Insurance CuES 2023, which captures interesting insights about consumers’ perceptions and experiences with life insurance brands.

The report identifies three major barriers to customers’ life insurance purchasing decisions: behavioral biases/ perceived need, economic constraints/affordability, and perceived difficulty in a purchase. Affordability has become a more pressing issue, and is even more exacerbated for women. One of the reasons is an increase in term product premiums. Moreover, those who have policies have listed their preference for monthly premium payment terms as much higher as compared to men.

Another key finding of the report is that 22% of customers cited 'Company does not keep in touch' as a potential reason for leaving. Direct contact at regular intervals can be more effective than impersonal digital channels alone in preventing lapse. In addition, 8 out of 10 customers would like the Bank RM/Agent to call/meet them after purchase, at least once every 6 months.

The report further states that consumers rank simplicity, transparency, and customization/ personalization as more important and key factors for differentiating between brands. In addition, physical consultative advice continues to remain a highly desired element even when making an online purchase.

Other interesting insights show Digital behavior on the rise across the customer journey, be it for pre–purchase information on the company website serving as the first frontier or service communication like payment reminders. Brand perception of digital service is another extremely critical aspect for the online buyer along with Customer Support. Moreover, with customers seeking multimode communication via digital channels, WhatsApp has become the preferred mode for reminder communication (41% in 2023, vs 31% in 2022). Also there is a steady rise in preference for Online Payment Mode (via UPI / Credit / Debit card / Net Banking) which has grown from 62% in 2021 to 67% in 2022 and 73% in 2023.

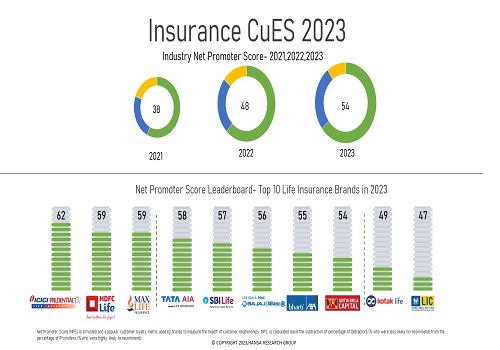

The Insurance CuES 2023 report has ranked ICICI Prudential Life Insurance as the leading Life Insurance brand as per industry Net Promoter Score (NPS), followed by HDFC Life Insurance and Max Life Insurance. Customers rated these top-performing brands significantly higher on various parameters such as digital experience, ease of dealing, easy documentation, communication, and responsiveness of their distribution channels. As a result, they have taken the top spots among all the life insurance providers, with impressive NPS scores of 62, 59, and 59 respectively. Brands like Tata AIA Life Insurance and SBI Life Insurance have also improved their ranking. According to the report, the industry's Net Promoter Score is now 54, up from 48 in 2022.

An additional noteworthy finding is that while LIC retains the highest brand awareness, it has slipped marginally in terms of advocacy and has been displaced in the overall ranking for the year 2022. Other brands that score high on brand awareness include SBI Life Insurance, HDFC Life Insurance, Bajaj Allianz Life Insurance, and ICICI Prudential Life Insurance.

Methodology: Approximately 3300+ life insurance policy holders, pan India were asked a series of questions relating to their experience as a policy holder, including the Net Promoter Question. This is an annual survey which covers 12 brands each year and 2023 is the 3rd edition. A separate sample of non-customers of life insurance were also surveyed. Insurance CuES 2023, which captures exciting insights about the perception and purchase of life insurance in India, ranks Insurers by Net Promoter Score (NPS).

Above views are of the author and not of the website kindly read disclaimer