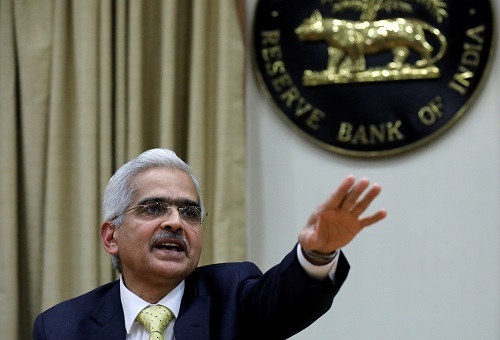

RBI’s new rules for microfinance institutions to help widen profits: Crisil

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Crisil Ratings in its latest report has said that Reserve Bank of India’s (RBI) new rules for microfinance institutions (MFIs), who have been deeply impacted in the Covid 19 pandemic because of loan losses, will help widen profits by giving such entities greater flexibility in operations. It said removing the interest margin cap on loans, the biggest change in regulation, will help NBFC-MFIs (non-banking finance company-microfinance institutions) adopt a risk-based pricing approach and hence support profitability.

According to the report, specifically, this will benefit mid-sized entities, which were handicapped by the lending rate cap linked to the base rate, given their relatively higher borrowing cost, and those with rural focus, where competition is less and borrowers are relatively less sensitive to interest rates. It said the move to increase the permissible household income to Rs 3 lakh per annum and the increase in limit of non-microfinance loans to 25 per cent of total assets will help increase the addressable market for such entities.

The report further said that the last two years have been extremely challenging for microfinance lenders as they grappled with high credit costs. It stated that the changes announced will help NBFC-MFIs adopt risk-based pricing and improve their profitability, expand their addressable market and also address concerns on over-indebtedness of borrowers.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">