RBI lowers FY22 inflation projection to 5.3, sees further softening

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

The Reserve Bank of India on Friday lowered FY22 retail inflation projection for the ongoing financial year to 5.3 per cent from the previous estimate of 5.7 per cent.

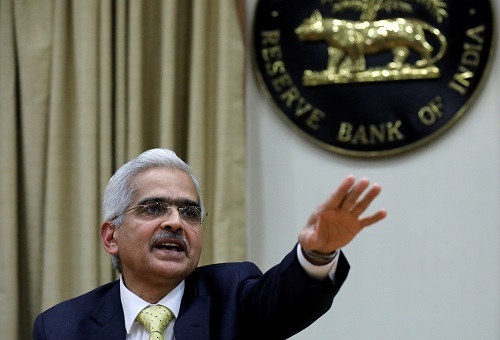

In a virtual address post the monetary policy meet, RBI Governor Shaktikanta Das said that consumer price inflation softened during July-August, moving back into the tolerance band with an easing of food inflation.

This is corroborating the Monetary Policy Committee's (MPC) assessment of the spike in inflation in May as transitory, he said.

Das cited moderation in food inflation as a key driver of the disinflation.

However, he pointed out that fuel inflation edged up and CPI inflation excluding food and fuel inflation (core inflation) remained elevated.

Besides, he expects a further softening can be expected in CPI-based inflation.

"Overall, the CPI headline momentum is moderating which, combined with favourable base effects in the coming months, could bring about a substantial softening in inflation in the near-term," Das said.

He pointed out that CPI inflation is projected at 5.1 per cent in Q2, 4.5 per cent in Q3, and 5.8 per cent in Q4 of 2021-22, with risks broadly balanced.

The projection on inflation for Q1 of next fiscal (FY23) is 5.2 per cent.

"We are watchful of the evolving inflation situation and remain committed to bring it closer to the target in a gradual and non-disruptive manner."

In a bid to continue with its growth supporting stance, the RBI has retained its key short-term lending rates during the fourth monetary policy review of FY22.

The MPC of the central bank voted to maintain the repo rate, or short-term lending rate, for commercial banks, at 4 per cent.

The growth-oriented accommodative stance was retained to give a push to economic activity despite high retail inflation levels.