Quant Pick - Buy Exide Industries Ltd For Target Of Rs. 230 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Derivatives and Quantitative Outlook…

* Broader markets have started recovering post the announcement of Union Budget 2021. In the midcap space, stocks like Exide Industries accumulated significant long positions in the last couple of months. It is likely to continue its upward bias in the near term

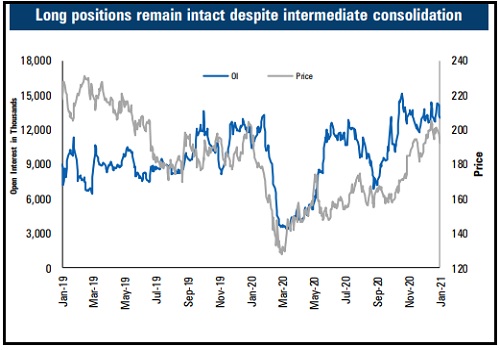

* The open interest in Exide Industries has been gradually increasing in the last couple of months as the stock exceeded its major hurdle of | 175 in the November series. Since then, long positions are still intact in the stock. Current OI in the February series is almost at par with three months. We believe these are long positions

* From the options space, the stock has the highest Call option base placed at the 210 strike followed by 200 strike. As it started seeing momentum, closure of positions was seen in ATM Call strikes. These positions are shifting to higher OTM strikes. At the same time, Put open interest base is strengthening at the 170 and 180 Put strike, which is the crucial support for the stock for the ongoing momentum. Thus, we believe current levels provide a good entry opportunity from a risk-reward perspective

* In November 2020, Exide had broken out from its broader trading range of | 150-175 levels. Also, the stock has witnessed the significant delivery volume activity around | 175 levels. These levels seem very crucial. In such a scenario, the positive bias may continue in the stock till these levels are held

* In December to January, the stock had witnessed an impulsive up move towards | 210. Since then, it has remained largely range bound with time based correction. This recent decline towards | 190 has given another opportunity to go long on the stock for fresh upsides

Buy Exide Industries in range of Rs. 188-194; Target: Rs. 230; Stop Loss: Rs. 172.5; Time frame: Three months

To Read Complete Report & Disclaimer Click Here

For More ICICI Direct Disclaimer http://icicidirect.com/disclaimer.html

SEBI Registration number is INZ000183631

Above views are of the author and not of the website kindly read disclaimer