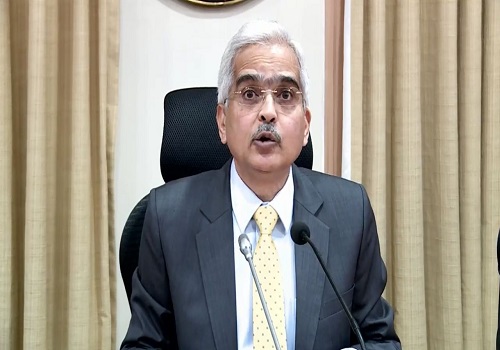

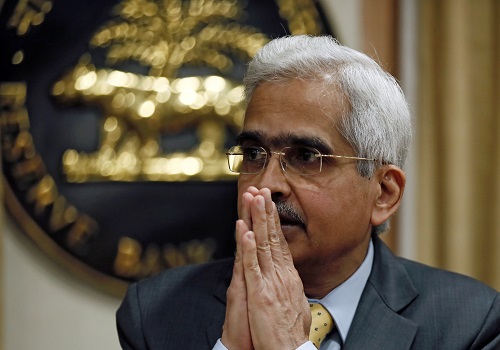

Monetary policy is an art of managing expectations: Shaktikanta Das

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Reserve Bank of India (RBI) Governor Shaktikanta Das has said ‘monetary policy is an art of managing expectations’ as he emphasised the need for an effective communication strategy amid concerns over rising inflation fuelled by geopolitical developments. He said the conduct of monetary policy has undergone notable changes in India and across the world as economies and markets evolved and policymakers gained greater insights into how economic agents interact in a complex economic system.

He noted that ‘As monetary policy is an art of managing expectations, central banks have to make continual efforts to shape and anchor market expectations, not just through pronouncements and actions but also through a constant refinement of their communication strategies to ensure the desired societal outcomes’. He added the communication works both ways -- while too much communication can confuse the market, too little may keep it guessing about the central bank's policy intent. The central bank also recognises that communication needs to be backed by commensurate actions to build credibility and instil wider confidence in policies.

He said the Reserve Bank of India (RBI) has actively used communication through a variety of tools -- the MPC resolutions and minutes, exhaustive post-policy statements together with a statement on developmental and regulatory measures, press conferences, speeches and other publications, especially the biannual Monetary Policy Report (MPR) -- to anchor expectations. The governor informed that price stability under the statute has been defined numerically by a target of 4 per cent for headline Consumer Price Index (CPI) with a tolerance band of +/- 2 per cent around it. The flexibility in the FIT (flexible-inflation targeting) regime comes from provisions to accommodate or see-through transitory supply-side shocks to inflation.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings