Q1 2022 Investment inflows into Indian realty up 2X YoY at USD1.1 bn - Colliers

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

* Investment inflows unabated from Q4 2021.

* Domestic investments at 30% of overall investments, almost in line with pre-pandemic levels after moderating in 2020

* Multi-city deals account for 65% of the inflows in Q1 2022

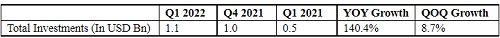

Institutional investments in Indian real estate touched USD1.1 billion during Q1 2022, doubling from the same period last year. The opening up of the economy post the third wave of Covid -19 infections, and an improvement in investors’ sentiment has led to surging investments, compared to the prior quarter. The investment activity during the quarter was driven by some large-sized deals in the office sector

Real estate institutional investments.

Investments were largely driven by foreign investors, that accounted for about 70% of the inflows during the quarter. Interestingly, after a drop in 2020, the share of domestic investments has reached 30%, almost the same as pre-pandemic levels. This shows a resurgence in the confidence of domestic investors.

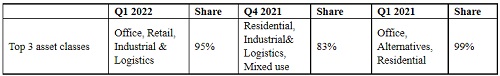

Key asset classes

Piyush Gupta, Managing Director, Capital Markets & Investment Services, Colliers India, said, "Real estate sector has undergone positive structural changes and performance indicators reflect strong come back across Residential, Office, Industrial, Logistics sectors, with newer themes around technology and digital clearly emerging. Investors, both domestic and global are appearing bullish on Indian real estate supported by pro-growth government policies with a long-term view to develop and hold assets. From a city level, Mumbai continues to be the market leader with a share of 25% in total investment inflows. This shows immense confidence of investors in the sector”.

The office market has made a comeback in terms of investments, with occupiers continuing to see it as a stable income-accruing asset class. Moreover, the office market is now recovering with Q1 2022 seeing stable vacancies for the first time in two years. The retail sector attracted the second-highest share of investments at 23%, backed by one major transaction. Investment in the retail sector was the highest since the start of the pandemic. Global investors continue to show strong interest in under construction as well as stabilized retail assets, as they are expecting a revival.

Industrial and logistics assets received inflows of 0.2 USD billion, accounting for about 16% of total investments. Investor appetite for industrial and logistics assets remained robust backed by strong structural demand from e-commerce and 3PL firms. Investors continued to scout for land parcels for in-city warehouses and in the peripheral locations of larger markets. Heightened investment activity is seen on the back of strong demand for modern industrial and logistics assets coupled with a shortage in supply.

“Multi-city deals accounted for 65% of the total investments in Q1 2022 as investors laid focus on entering into strategic alliances with leading developers and on acquiring/developing portfolios across multiple cities. We are also seeing the creation of platforms for investment in specific asset classes, especially across the commercial office and industrial asset classes”, says Vimal Nadar, Senior Director and Head of Research, Colliers India.

Residential likely to see increased fund flows as fundraising remains strong

Investments in the residential sector remained muted attracting only USD15 million in Q1 2022, just about 1% of the total investments. However, we expect investment momentum to increase over the next few quarters as domestics investors remain bullish on the sector and are actively raising funds. The residential sector is witnessing tailwinds amid a significant rebound in sales momentum after a turbulent spell since the NBFC crisis in 2018, followed by the pandemic. In Q1 2022, a major investment group marked the close of an affordable housing fund, one of the largest funds targeted towards residential real estate in India.

Global REITs and data centre management firms continue to expand their portfolios in India

Investments in data centres continued to grow in Q1 2022 to about USD40 million, as global data centre REITs, data centre management firms and hyperscalers continued to invest in India. Chennai is witnessing significant traction in data center development and has the potential to emerge as a key data centre hub in South Asia due to its strategic location as submarine cables landing station. Investment opportunities in data centres are surging, given the huge growth in demand for cloud computing from enterprises, deeper internet penetration, and infrastructure status granted to data centres.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">