Proximity towards the lower end of the channel range - Tradebulls

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty

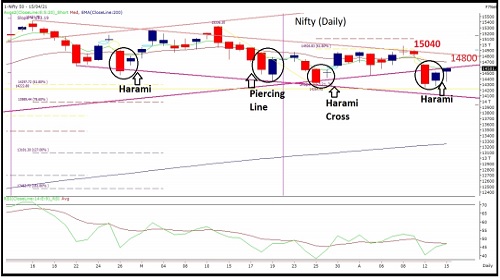

Index saw yet another bullish reversal formation near its support in form of Bullish Harami. We did see the index slipping below its important trading support around 14500 & slipping towards 14300 but again a reversal post the breakdown reinstates the support base to hold around 14300-14400 zone its self.

Proximity towards the lower end of the channel range with most oscillators now in their respective oversold zone is a sign of caution again. Its multi weeks support zone is placed around 14400 while the ongoing declining channel support is now trending around 14300-14200; hence the zone of 14400-14200 could be a value add zone for investors & positional traders to accumulate quality stocks.

While traders should continue to trade with the trend will low leverage opportunities due to the upcoming oversold nature of the markets. Technically, a decisive break only above 15040 from hereon could push the index towards 15700, once the directional momentum unlocks. Until then since the odds remain in favour of the investors, its ideal to retain the buy on declines strategy for investors & positional traders.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.tradebulls.in/Static/Disclaimer.aspx

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Opening Bell : Markets likely to get gap-down opening tracking sell-off in global markets

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">