Press Release: India Real Estate January – June 2021 Report By Knight Frank India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

RESIDENTIAL SALES RECORD 67% YOY INCREASE IN H1 2021 DESPITE

SECOND WAVE; LAUNCHES RISE 71% YOY: KNIGHT FRANK INDIA

* Q2 2021 records 185% YoY rise as the second wave of Covid-19 remained

less disruptive for the sector despite severity

* Sales momentum helps contain fall in residential prices in H1 2021

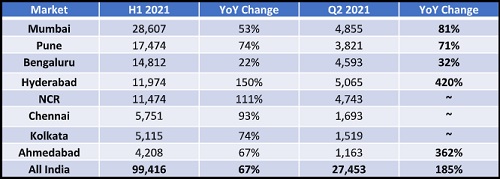

Mumbai, July 15, 2021: Knight Frank India, a premium international property consultant, in their

latest market assessment report “India Real Estate – Residential, January-June 2021” – recorded

total sales of 99,416 residential units in the first half of 2021 (H1 2021) across top markets, while

new launches in the same period (January – June 2021) were recorded at 103,238 units. As sales

volumes stabilized, especially in the early part of H1 2021, unsold inventory reduced by 1% over the

same period last year. Prices remained mostly contained with a reduction of -1% to -2% Year on Year

(YoY).

A TALE OF TWO CITIES AND THE PANDEMIC – SECOND WAVE LESS SEVERE ON RESIDENTIAL REAL

ESTATE THAN FIRST WAVE

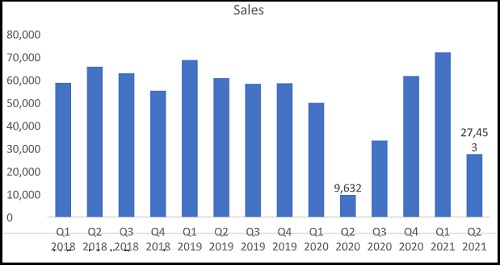

H1 2021 saw a rise of 67% YoY in sales volume with the first half of this period recording the larger

part of the total volumes. During the early part of this year, sales volumes were greatly influenced by

two markets – Mumbai and Pune, that together constituted over 45% of the total sales amongst key

markets. These two markets were given their orbital velocity by the Maharashtra government’s

decision to lower stamp duty rates for a limited period. While residential sales started to show a

resurgence, the momentum got impacted by the second wave of the pandemic starting towards the

end of March 2021. Interestingly, the period of the second wave coincided with that of the first

wave last year which had brought the residential sales market to a screeching halt. Fortunately, the

second wave, despite its extremely morbid potency, was less severe on the residential real estate

market.

A clear outcome of the pandemic was seen in the share of mid-range and high-end property

segments. The share of sales of homes costing less than INR 50 lakhs reduced by around 500 basis

points (BPS) and constituted 42% of all sales in the January-June 2021 period. Homes costing over

INR 1 crore constituted about 19% of all sales, while units at INR 50 lakhs to 1 crore improved by

approximately 400 BPS to be at 39%. The reducing proportion of affordable homes (less than 50

lakhs) is directly related to the challenges thrown up by the pandemic which reduced the economic

confidence of home buyers in that category due to the threat of job loss, reduced income, inching

CPI and other challenges.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

Tag News

Rise in housing prices unabated at 7% YoY in Q2 2023: CREDAI - Colliers - Liases Foras | Hou...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">