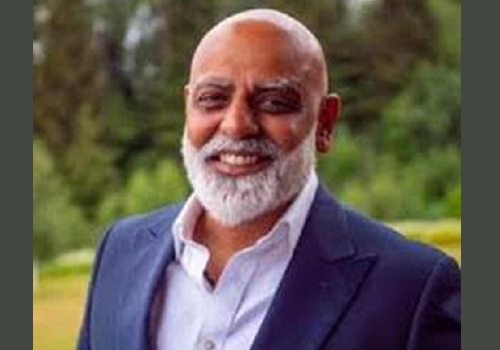

Perspective on expectation from RBI Monetary Policy By Ms. Rajani Sinha, Knight Frank India

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is Perspective on expectation from RBI Monetary Policy By Ms. Rajani Sinha, Chief Economist and National Director - Research, Knight Frank India

“RBI has started the process of normalization by mopping out excess liquidity from the system through enhanced VRRR auction and suspending the G-SAP. There was growing expectations that in the December MPC meeting, RBI would hike the reverse repo rate to narrow the corridor between repo and reverse repo rate. However, the new COVID variant Omicron has again pushed the global and Indian economy in a state of uncertainty and nervousness. There is also added uncertainty of any knee-jerk reaction of Indian and global financial markets to Fed’s monetary policy indication/action. In such a scenario, RBI in its upcoming meeting is likely to keep the rates on hold. On the growth front, while most economic indicators have surpassed pre-Covid levels, there is still a lot of slack in the economy. Hence RBI may decide to wait and watch till the next MPC meeting in February 2022.

RBI will be concerned about inflationary pressure building in the economy. Currently the upward pressure on inflation is because of high commodity prices and supply bottlenecks. However, with economic growth gathering momentum, there is threat of further demand side pressure on inflation. We can expect RBI to start hiking rates from 2022. RBI will also narrow the corridor between repo and reverse repo rate, with sharper hike in reverse repo rate. The quantum of rate hike will be dependent on how the COVID scenario pans out and its subsequent impact on economic growth in 2022”.

Above views are of the author and not of the website kindly read disclaimer

Top News

Kronox Lab moves up on getting provisional consent for setting up Industrial Plant at Dahej

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

More News

Comment on Monetary Policy by Mr. Ankit Gupta, Director, Reach Group, a leading real estate ...