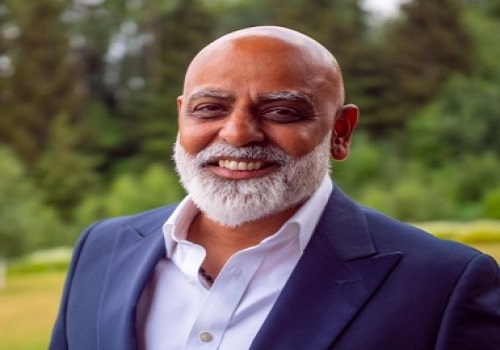

Perspective on RBI MPC announcement By Shri. Shanti Lal Jain, Indian Bank

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below is Perspective on RBI MPC announcement By Shri. Shanti Lal Jain, MD & CEO of Indian Bank

As expected, to curb the inflationary pressures, RBI has hiked the policy rates by 50 bps ensuring price stability. The series of measures including reduction of excise duty on Petrol/Diesel announced by the Government are all likely to help in tempering the inflation trajectory. The revision of inflation projection for the current fiscal at 6.7%, adding that RBI is committed to rein-in inflation while keeping growth in mind. More relaxation to Co-operative Banks will further help in bank credit growth and financial inclusions.

Much thrust has been given on Digital penetration by enhancing limit of e-mandate on cards, linking of UPI to Credit Cards (Rupay) and enhanced subsidy on PIDF (Payment Infrastructure Development Fund) scheme.

There is a gradual recovery in the economy and hence the withdrawal of accommodation in a calibrated manner is supportive to the growth while containing the inflation.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings