Opening Bell : Benchmarks likely to make positive start on last trading day of 2022

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

Indian markets closed in the positive territory after trading lower for most part of the session on Thursday on fag-end buying in telecom, banking and metal stocks. Today, benchmark indices are likely to make a positive start on the last trading day of the calendar year (2022) tracking strength across global markets. Sentiments will get a boost as Reserve Bank of India (RBI) Governor Shaktikanta Das said the Indian economy is resilient with financial stability maintained with a well-capitalised banking sector, amid global uncertainties and shocks. Some support will come as Union Commerce Minister Piyush Goyal said he expects at least two more free trade agreements to be signed up in 2023. He also said negotiations are scheduled with the UK, European Union and Canada. However, traders may be concerned as data released by the Reserve Bank showed that the country's current account deficit widened to 4.4 per cent of the GDP in the quarter ended September, from 2.2 per cent GDP during the April-June period, due to higher trade gap. There may be some cautiousness as the finance ministry said India's external debt stood at $610.5 billion in the second quarter of 2022-23, down by $2.3 billion from end-June 2022. The external debt to GDP ratio stood at 19.2 per cent as at end-September 2022 as compared to 19.3 per cent at end-June. There will be some buzz in banking stocks as the RBI said banks' gross NPA ratio has fallen to a sever-year low of 5 per cent and the banking system remains sound and well-capitalised. In the 26th issue of the Financial Stability Report (FSR), the RBI also said the global economy is facing formidable headwinds with recessionary risks looming large. Real estate industry stocks will be in focus as CRISIL expects primary residential sales to post modest volume growth of 3-8 per cent on-year in 2022-23 (FY23) on a high base of the previous year for the top eight cities. It added that the increase in primary residential sales will be despite a reversal in the purchasing power of homebuyers. There will be some reaction in textile industry stocks as the Confederation of Indian Textiles Industry said the India-Australia Economic Cooperation and Trade Agreement, which came into force from December 29, is set to provide a big relief to Indian textile exporters. Meanwhile, shares of Elin Electronics will debut on the bourses today.

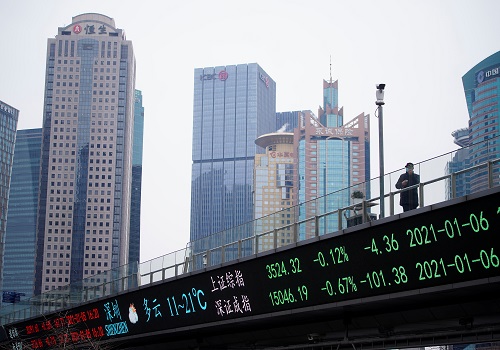

The US markets ended higher on Thursday as investors sought to snap up bargains in the tech sector, looking past worries that new variants could emerge from China's continuing COVID outbreak. Asian markets are trading in green on Friday following overnight gains on Wall Street.

Back home, Indian equity benchmarks erased early losses and closed with gains on the F&O expiry day, led by the Oil & Gas, Metal and Energy stocks. Both benchmarks opened in the red and traded lower for most part of the trading session amid weak global cues. Sentiments remained downbeat with a private report stating that after three consecutive years of infusing huge funds, foreign portfolio investors retreated from the Indian equity markets in a big way in 2022 with the highest-ever yearly net outflow of nearly Rs 1.21 lakh crore. Some pessimism also came with RBI Monetary Policy Committee (MPC) Member Ashima Goyal’s statement that the government should not go in for an 'aggressive fiscal consolidation' in the upcoming budget as global risks have not abated. However, last hour buying erased all the intraday losses to help the bourses close on a positive note. Traders found solace with Crisil’s report stating that strong domestic demand, healthier corporate balance sheets, and a well-capitalised banking sector are expected to steer India towards a 7 per cent gross domestic product (GDP) print in 2022-23. Traders got some support with report stated that free trade agreement (FTA) between India and Australia, which comes into effect from December 29, 2022, will help boost bilateral trade in goods and services to cross $70 billion in the next five years. Adding to the optimism, various export promotion councils (EPCs) lauded the trade agreements signed by India with the UAE and Australia, saying the pacts will help the country in boosting exports by granting preferential access to those markets for Indian products. Finally, the BSE Sensex rose 223.60 points or 0.37% to 61,133.88 and the CNX Nifty was up by 68.50 points or 0.38% to 18,191.00.m

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Nifty closed at 15246 with a gain of 327 points - Axis Securities