On Friday, the Bank Nifty stared on a negative note - Angel Broking Ltd

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (50890) / Nifty (14982)

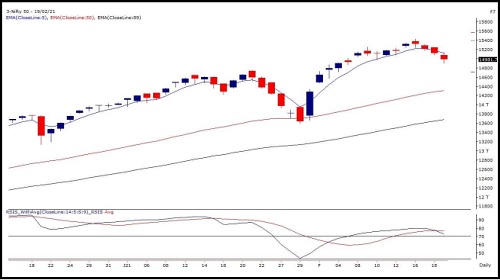

After a brief pause in the previous week, our markets resumed their upward momentum on Monday on the back of global optimism and encouraging macro numbers. The upward move continued on the following day as well to clock fresh record high of 15431.75. However, at higher levels, most of the heavyweight counters started experiencing some profit booking, which extended as the week progressed. In this process, the Nifty eventually sneaked below the psychological mark of 15000 on Friday to snap the weekly winning streak.

For the major part of the week, the market has been experiencing some pressure at higher levels and this is what we have been alluding to in our intra-week commentaries. Technically speaking, last week’s high precisely coincided around the crucial resistance zone of 15380 – 15500 (which is the 161% ‘Golden Ratio’ of the entire fall from Jan’20 highs to March’20 lows). Hence, some sort of pause around it was quite evident. Although, market has come off a bit in last three sessions, structurally there is no major damage done on the charts. It should merely be considered as a profit booking as of now. Going ahead, we need to keep a close eye on how Nifty behaves around its key support zone of 14750 – 14550. Only a sustainable breach of these crucial levels should be considered as a short term trend reversal. On the flipside, 15100 – 15200 would be seen as immediate hurdles and any bounce towards this is most likely to get sold into.

Nifty Daily Chart

Nifty Bank Outlook - (35842)

On Friday, the Bank Nifty stared on a negative note, and then it attempted to bounce back that got sold into to mark an intraday low of 35585. During the final hour, there was a spike in volatility to eventually conclude with a loss of 2.04% at 35842. The week started on a strong positive note on Monday however we addressed in our outlook that not to have aggressive long positions as markets were in deep overbought territory. In the remaining part of the week, the market kept on sliding to end with a loss of 0.74% against the previous week. During the week, we witnessed a mixed bag of pictures as private banks were under pressure whereas the PSU banks were outperforming however we can say the major momentum was on the bears' side. Going ahead, immediate support is placed around 35400 - 35000 levels whereas 36200 and 36500 is the immediate resistance. Traders can continue with a stock-specific approach for the monthly expiry week however needs to avoid aggressive bets as we have seen a spike in intraday volatility.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Nifty has an immediate resistance placed at 17750 and on a decisive close above expect a ris...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">