Nifty to resolve out of ongoing consolidation, head towards 15100 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty to resolve out of ongoing consolidation, head towards 15100….

Technical Outlook

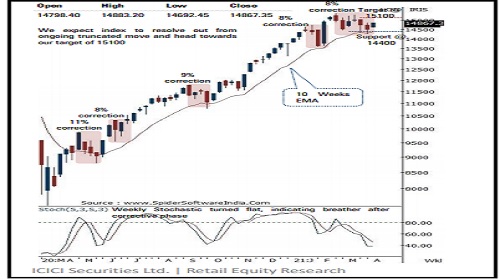

* Equity benchmarks snapped their two week’s corrective phase and concluded the truncated week on a positive note. The Nifty ended the week at 14880, up 2.6%. Sectorally, all major indices ended in the green led by metal, pharma, FMCG.

* The weekly price action formed a small bull candle, indicating a pause in corrective bias as on expected lines the index consolidated in the broad range of 14400-14800 and maintained the rhythm of its maturity of price-wise and time-wise correction

* Going ahead, we reiterate our positive stance as we expect the Nifty to gradually retest its all-time high of 15430 in coming months. Our constructive stance on the market is based on:

* a) Over past one year, intermediate average correction to the tune of 9% have subsequently produced rally back to lifetime highs. We expect market to maintain this rhythm

* b) Gyration of sectoral leadership along with improving market breadth signifies rejuvenation of upward momentum that makes us confident that the index would resolve higher. Hence, traders can use intermediate volatility to their advantage to build incremental long positions by accumulating quality large cap, midcaps

* Key observation from recent price action is that rallies have started getting elongated whereas corrections have been shallower, leading to truncated price action. In the coming week, we expect the index to resolve out from this truncated move and head towards our target of 15100

* Sectorally, IT, pharma, financials, infra and consumption are expected to outperform. On the stock front, TCS, Adani Ports, Cipla, Bajaj Finserv, Tata Motors, IndusInd preferred in large caps while Graphite, Philips Carbon, Glenmark Pharma, KNR Constructions, JK Lakshmi, V-Guard, Symphony, Persistent, Tata Chemicals are expected to outperform among midcaps

* The broader market indices relatively outperformed the benchmark after forming a higher base above their 50 days EMA coinciding with upward sloping trend line, which has been held on multiple occasions since June 2020, indicating robust price structure. Meanwhile, global broader market indices are approaching their life highs after recent breather. We expect domestic midcaps to maintain the positive correlation with its global peers and eventually endure their relative outperformance in coming weeks

* Structurally, we believe the index has formed a higher base in the vicinity of 14400 as it is 61.8% retracement of post Budget rally (13662-15432), at 14338 In the coming session, index is likely to open on a flat note. We expect index to trade with a positive bias while maintaining higher high-low. Hence, use intraday dip towards 14860-14885 to create long for 14970

NSE Nifty Weekly Candlestick Chart

Nifty Bank: 33858

Technical Outlook

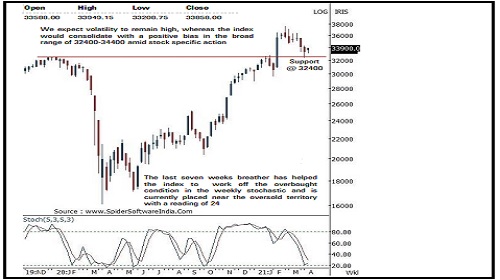

* The Nifty Bank index snapped a two weeks corrective decline and concluded truncated week on a positive note up by more than 1 . 5 % on weekly basis amid strong global cues . The up move was broad based as both PSU and private banking stocks witnessed rebound after recent decline . The Nifty Bank closed the week at 33858 levels up by 540 points or 1 . 6 %

* The weekly price action formed a small bull candle which remained enclosed inside previous week range signalling pause in corrective bias as on expected lines index consolidated in the broad range of 34400 -32400 . The index has recently rebounded after testing the major breakout area above the yearly high of CY 2019 & CY 2020 placed around 32500 levels

* Going ahead , we expect the index to continue with its current consolidation with positive bias in the broad range of 34400 - 32400 with stock specific activity .

* The index has immediate hurdle at 34400 levels as it is the confluence of the recent breakdown area and 50 % retracement of the last leg of decline (36497 -32415 ) .

* The last seven weeks corrective decline has lead to the weekly stochastic placed near the oversold territory with a reading of 24 indicating an impending pullback in the coming weeks . However, the index require to start forming higher high -low in the daily chart on a sustained basis and close above the immediate hurdle of 34400 to signal a resumption of fresh up move

* The major support for the index is currently placed at 32600 - 32400 levels being the confluence of the following technical observations : a) 61 . 8 % retracement of the previous rally (29687 -37708 ) placed at 32750 levels b) Major breakout area of previous multiple yearly highs placed around 32500 levels

* In the coming session, the index is likely to open on a soft note . Volatility is likely to remain high . We expect the index to continue with its current pullback and continue to form higher high -low in daily chart . Hence, use intraday dips towards 33720 - 33780 to create long position for target of 33990 , maintain a stoploss of 33610

Nifty Bank Index – weekly Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Top News

Consumer demand is shifting from goods to services suggests contraction in demand for durables

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct