Nifty midcap and Smallcap Indices outperformed the benchmark Indices as they ended with the gains of 0.59% and 0.43%. - HDFC Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

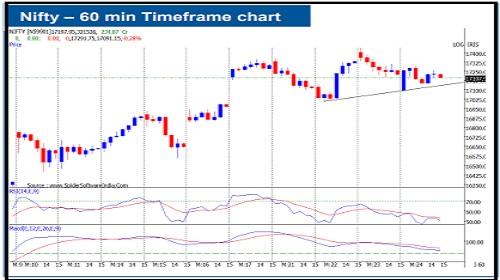

Daily Technical View on Nifty

Remain Long with 17000 Stoploss

* For last 5 trading sessions, Nifty has been consolidating in the narrow range of 200 odd points on closing basis.

* Nifty midcap and Smallcap Indices outperformed the benchmark Indices as they ended with the gains of 0.59% and 0.43%.

* Though, declines outnumbered the advances where advance decline ratio stood at 0.75 on BSE, positive Midcaps and Smallcap Indices indicates stock specific market.

* On the down side 50 days EMA has been acting as a support, which is currently placed at 17074. Ø Resistance for Nifty is seen at 17484, which happens to be the 61.8% retracement of the entire downswing seen from 18604 to 15671.

* BankNifty continued its underperformance, as it plunged more than 1.7% against minor fall in Nifty. Ø Any level below 35300 in BankNifty could invite some more selling in the index.

* IT, Metals and Energy sectors are looking strong on the short term charts, While Banks and Auto could remain under pressure.

* Nifty should be held long with 17000 stoploss.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ000171337

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Nifty registers best week in 2 months after rising for 6 consecutive sessions