Nifty likely to respect highest Put base of 14500 in March settlement - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty likely to respect highest Put base of 14500 in March settlement...

* The Nifty witnessed extreme volatility last week and made lows near 14350 as sustained selling was seen on every rise. Some recovery was seen on Friday helping the Nifty to end near 14750, losing almost 2% in the week. Meanwhile, broader markets also remained lacklustre and both midcap and small cap indices underperformed the Nifty. Going ahead, we expect the Nifty to respect its highest Put base at 14500 for the March settlement while stock specific volatility is likely to continue due to rollover activity

* While banking remained a major laggard, the technology and pharma space also joined in the last few sessions as the Nifty moved below 14500. However, stocks from the FMCG space exhibited some resilience and witnessed a sharp pullback on Friday along with Reliance Industries helping the index to recove

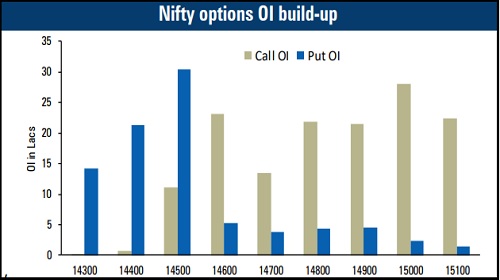

* On the data front, the major Call base for the settlement week is placed at 15000 strikes, which should be immediate hurdle for the index in the short term. Moreover, the roll spread for the April series is significantly higher near 80 points. Such high spread indicates prevailing caution in the market. Despite the large move seen on Friday, no major change in options accumulation was seen and major OI distribution remained at 14500 Put and 15000 Call. Moreover, March series VWAP levels near 14900 should act as immediate hurdle for the March settlement

* Despite recent declines, volatility index VIX has remained subdued and hovered around 20 points. While Put writers have moved lower, aggressive writing in Call options has kept the volatility index under pressure. Hence, a sharp reversal in the index seems less probable at the current juncture

Bank Nifty: Major support for index at 33000 levels…

* The Bank Nifty violated its Put base much earlier than the Nifty and traded below 35000, which resulted in further profit booking during the week. Most banking heavyweights gave up their gains and approached its Put base of the March series. However, the volatility index remained muted near the 20% band despite aggressive selling in the week along with appreciation in the rupee

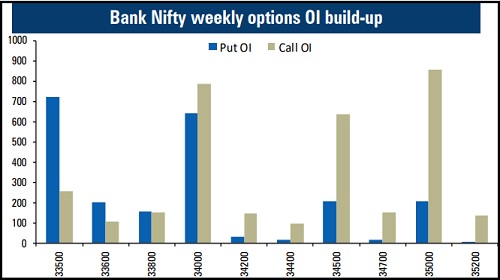

* The Bank Nifty made a low of 33400 last Friday and reverted almost 900 points in intraday itself. The banking index has started the coming week with highest Call & Put base at the 34000 strike. We feel this will force the index to remain in a broader range with strong support for the expiry week at 33000 levels

* Stock specific activity should be seen due to rollover but we feel the index is likely to move towards 35000-35200 on upsides. Due to elevated IVs in Bank Nifty, OTM Put writing is visible, which is likely to limit downsides

* The current price ratio of Bank Nifty/Nifty declined marginally to 2.31 levels. We feel the ratio has strong support near 2.30-2.28 range and major underperformance in banking stocks is unlikely to happen

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Opening Bell - Markets likely to open in red on ahead of monthly F&O expiry

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">