Nifty is expected to open on flattish note and expected to trade sideways during the day - Nirmal Bang

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Market Review:

Indian markets ended with small gains on Monday. Value buying emerged after the market tumbled in the past six sessions. Firmness in banks and auto shares boosted the indices. On the otherhand, IT and FMCG shares witnessed selling. Sensex rose 180.22 points or 0.34% to 52,973.84. The Nifty 50 index 60.15 points or 0.38% to 15,842.30.

Nifty Technical Outlook

Nifty is expected to open on flattish note and expected to trade sideways during the day. Technically, Nifty is trading in pattern of lower tops and lower bottom pattern suggesting potential downside. Nifty has an immediate support at 15770 level. If its fails to hold the support then we may witness more selling pressure towards 15670/15600. As of now Nifty has a resistance at 15870, any move above the same may witness a pull back rally towards 15970/16000. It’s a stock specific market trade calls with strict stop loss.

Action: Nifty has an immediate resistance placed at 15870 and on a decisive close above expect a rise to 15970/16070 levels.

Bank Nifty

Bank Nifty had witness a pull back rally from support level of 33000 mark towards 33600 mark. Going ahead this pull back rally is likely to sustain if Bank Nifty manages to hold 33200/33000 mark. The immediate resistance is placed at 33820, above that 34000/34370 mark may be seen.

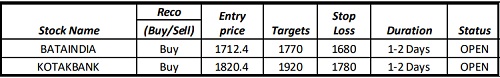

Technical Call Updates

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://investmentguruindia.com/Disclaimer/nirmal.html

SEBI Registration number is INH000001766

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Market Update : A positive development was the strong buying activity by foreign institution...