Nifty futures closed at 14987 on a negative note with 3.06% decrease in open interest indicating Long Unwinding - Axis Securities

HIGHLIGHTS:

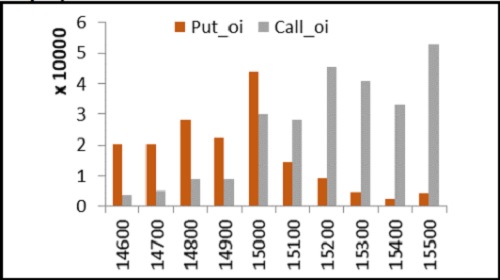

Nifty Options OI Distribution

Nifty futures closed at 14987 on a negative note with 3.06% decrease in open interest indicating Long Unwinding. Nifty Futures closed at a premium of 5 points compared to previous day discount of -3 points. BankNifty closed at 35850 on a negative note with 2.22% decrease in open interest indicating Long Unwinding. BankNifty Futures closed at a premium of 8 points compared to the previous day premium of 16 points.

FII's were Buyers in Index Futures to the tune of 281 crores and were Buyers in Index Options to the tune of 3984 crores, Buyers in the Stock Futures to the tune of 319 crores. Net Buyers in derivative segment to the tune of 4796 crores.

India VIX index is at 22.25 v/s 21.54.Nifty ATM call option IV is currently 16.64 whereas Nifty ATM put option IV is quoting at 16.72

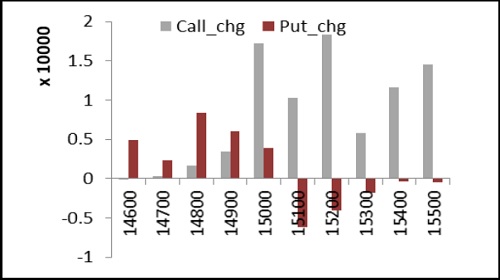

Nifty Options - Change in OI

Index options PCR is at 1.19 v/s 1.12 & F&O Total PCR is at 1.00.

Among stock futures Long Build up are CHOLAFIN, TATACHEM, CONCOR & UPL may remain strong in coming session.

Stock which witnessed Short Build up are AMARAJBAT, DABUR, CADILAHC & BIOCON may remain weak in coming session.

Nifty Put options OI distribution shows that 14000 has highest OI concentration followed by 15000 & 14500 which may act as support for current expiry.

Nifty Call strike 16000 followed by 15500 witnessed significant OI concentration and may act as resistance for current expiry

To Read Complete Report & Disclaimer Click Here

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

More News

Quote on Market 22nd August 2025 from Vinod Nair, Head of Research, Geojit Investments Limited