Nifty: Uptrend likely to continue towards 15200 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Uptrend likely to continue towards 15200

* Once again buying support came in for the Nifty and despite making lows below 14500 in the early part of the week, the Nifty rebounded strongly above 14800, gaining more than 1% in the week. Metals outshone rest of the sectors in terms of performance as metal index moved up almost 10% last week. At the same time, midcap, small cap indices also moved up nearly 1.5% each

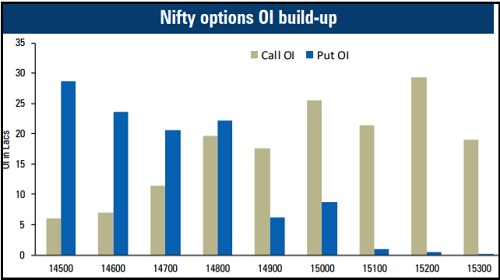

* On the data front, the Nifty still has the highest Call base at 15000 Call strike for the coming weekly settlement. Since mid-March, the Nifty was unable to close above these levels. However, gradual writing at OTM Put of 14600 and 14800 strikes suggest limited downsides. Till these levels are held, there is high probability that the Nifty could move towards 15200 in the coming sessions

* Sectorally, apart from metals, rest of the sectors have remained largely range bound to positive. For the Nifty to move above 15000, banking index has to lead from front. We believe that after a round of consolidation it is well poised for a further up move. We expect banking space to resume its outperformance once it closes above 34000. However, technology space is likely to underperform

* Volatility in the markets moved lower towards 20, which is the lowest level for volatility since mid-April. Sustainability of current levels may infuse fresh uptrend in the broader markets in the coming sessions. As suggested earlier, one should be cautious if it starts moving higher once again

Bank Nifty: Consolidation should continue with support shifted higher to 31500

* Broader markets marked a meaningful recovery and ended near the higher band of the consolidation with sectoral rotation helping the index to inch higher. Private banks continued to do well post their quarterly numbers whereas PSU banks also witnessed covering and moved higher

* During the week, the Bank Nifty saw almost 12% fresh long build-up in future along with price appreciation. This is a positive development. We feel the current leg of consolidation with positive bias should continue

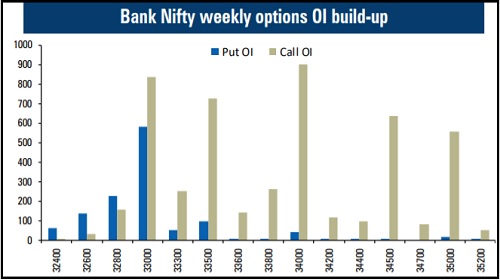

* IVs started declining from 24% levels along with additions seen in most OTM strike options. Similar activity was there last week post which the index remained in a range. We feel this week as well the index is likely to consolidate. To utilise this opportunity, we have recommended shorting Strangle for the week (31500 Put & 34000 Call)

* Among heavyweights, Axis Bank along with Kotak Mahindra Bank are likely to do well. Fresh up moves are expected above 34000. Until then, its advisable to write OTM options to capitalise on declining time value and earn premiums from the consolidation in the Bank Nifty

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Banking index remained volatile throughout the day and closed nearly unchanged - Religare Br...