Nifty: Sustainability above 14700 may trigger fresh uptrend - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Sustainability above 14700 may trigger fresh uptrend

*The Nifty recovered towards 14700 last week after witnessing a sharp fall of almost 500 points on Monday. Positive global cues also helped markets to move higher despite fears of fresh lockdowns and a depreciating currency. The Nifty closed the week with a loss of 1.6% while midcap and small cap indices closed the week with loss of almost 3% each. Sustainability of 14700 is expected to lead to a fresh up move

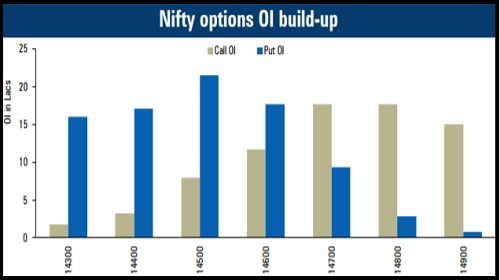

*On the data front, the Nifty has major Call base placed at 14700 strikes with highest Call base placed at 15000 strike for the weekly settlement. On the downside, 14500 remains a crucial support due to continued build-up seen in this strike. Hence, we believe that move above 14700 may trigger upside momentum towards 15000 in the April series

*Sectorally, after significant underperformance was seen from the BFSI space in the last few weeks, some short covering was experienced. We expect banking to take the lead from here onwards. It will be crucial for a market recovery towards 15000 level. Moreover, we may see some consolidation in the technology space post their quarterly results

*The volatility in the markets declined sharply and moved towards 20 levels once again after testing 23 levels on Monday. We expect volatility to remain subdued, which should bode well for the current recovery

Bank Nifty: Sectoral churning expected to trigger buying in banking…

*The Bank Nifty witnessed a volatile week where moves were seen on both sides. Private leaders continued to witness profit booking but stock like HDFC Bank reverted from their major Put base. However, PSU banks continue to remain laggard and witnessed continued selling pressure

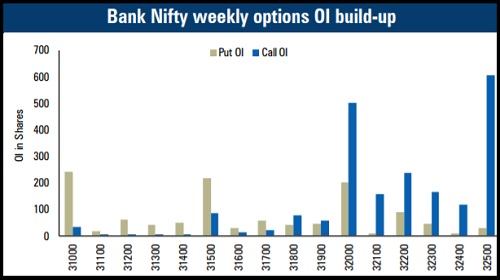

*As technology stocks witnessed profit booking post quarterly numbers of TCS and Infosys, sectoral rotation helped beaten down segment. Banking stocks witnessed some short covering to recover from the lows near 30500. In the last two sessions, fresh long OI build-up was observed as it closed near its sizeable Call base of 32000

*We feel the Bank Nifty should see some pick up in pace at the current juncture and stocks like HDFC Bank, Kotak Mahindra Bank should do well from current levels. Supportive action is expected from midcap banks like Federal Bank and Bandhan Bank

*On the options front, sizeable Call OI base is placed at 32000 followed by 33000. We feel downside should be limited and recent low should provide cushion. In contrast, a close above 32000 again should trigger a 1000-point rally

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct