Broader market relative outperformance to endure - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Broader market relative outperformance to endure…

Technical Outlook

* Equity benchmarks extended gains over a second consecutive week and scaled a fresh all-time high of 15257 amid firm global cues. The Nifty ended the week at 15163, up 1.6%. Broader markets relatively outperformed, as the Nifty midcap, small cap gained 2.1% and 3.7%, respectively. Sectorally, IT, metal, auto outshone while FMCG, pharma took a breather over the week. Technical Outlook

* The Nifty took a breather amid positive bias, after last week’s sharp up move, as it formed a small bull candle carrying a higher high-low formation. In the process, broader markets outperformed on expected lines

* We maintain our constructive stance on the Nifty with a target of 15500 in the coming month whereas prominent theme to play out to be outperformance of midcap and small cap category as:

* a) small cap indices of developed peers have been resilient with US index hitting fresh life-time high. Strong positive correlation with developed market peers would act as a tailwind for domestic indices

* b) Locally, we expect upward shift in trajectory of small cap index, which is 18% away from life highs (midcap index already at lifetime highs)

* Sectorally, telecom, IT, banks and auto heavyweights are expected to lead the Nifty towards its projected target of 15500, as it is 161.8% external retracement of last fall (14754-13596), at 15466

* The Dollar index has once again faced stiff resistance from downward sloping trend line and is currently hovering around multi year breakdown area of 90. The prolonging of weakness in Dollar index would be key monitorable, which will act as tailwind for emerging markets and provide impetus to domestic bourses

* Structurally, we believe the Nifty has strong support at 14600. We do not expect it to be breached. Hence, any temporary breather from here on should be capitalised on to accumulate quality stocks, as key support of 14600 is confluence of 38.2% retracement of current up move (13597-15257), placed at 14622 coincided with earlier consolidation breakout area around 14650

* In the coming session, Nifty future is likely to open on a positive note tracking firm global cues. We expect the index to trade with a positive bias and maintain a higher high-low formation. Hence, use intraday dips towards 15158-15182 to create long position for the target of 15272

NSE Nifty Weekly Candlestick Chart

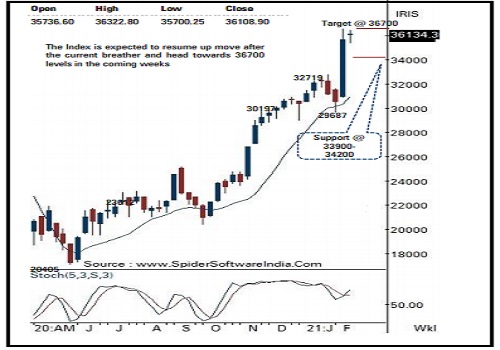

Bank Nifty: 36109

Technical Outlook

* The Nifty Bank settled higher in a choppy trading week . The private banks outperformed their public peers as profit booking set in PSU banks after sharp run up in preceding week . BankNifty index closed 1 . 3 % or 454 points up at 36109

* The weekly price action resulted in a High wave candle indicating a healthy breather after post budget rally measuring more than 23 % . The low of the week (35428 ) is placed at the last Friday’s bullish gap area (35344 -35545 ) and remains an immediate support for index for coming week . Sustaining above the same will lead to extended rally in coming weeks towards 36700 levels

* Key point to highlight is that after a 23 % rally in just seven sessions the daily stochastic had approached to overbought trajectory which has resulted in a sideways consolidation in the last four sessions . With this backdrop, current breather should not be seen as negative instead one should adopt buy on decline strategy as the overall structure remain firmly positive for up move towards 36700 levels as it is the 123 . 6 % external retracement of entire CY20 decline (32613 - 16116 )

* The key short term support for the index is placed around 34200 -33900 levels as it is the confluence of the following : a) 38 . 2 % retracement of the current up move 29687 to 36615 is placed around 33968 levels b) Value of a bullish gap post Budget day at 33583 levels In the coming session, the index is likely to open on a flat note tracking mixed global cues . We expect index to trade with a positive bias while holding above Thursday’s low (35573 ) .

* Hence , after a soft opening we recommend to utilize intra day dips towards 36110 -36155 for creating fresh long positions in Bank Nifty February Futures for target of 36315 meanwhile stop loss is placed at 36048

Bank Nifty Index – Daily Candlestick Chart

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Nifty saw yet another day of profit booking near its life high zone - Tradebulls Securities ...