Nifty: Sustainability above 14600 crucial for fresh uptrend - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Sustainability above 14600 crucial for fresh uptrend

* The continued rising Covid cases have led to underperformance of Indian equities last week as well with respect to global markets. However, the Nifty consolidated largely above 14300, after witnessing another 500 points decline on Monday and closed the week negative. Meanwhile midcap and small cap indices closed the week with in the green amid significant sectoral churning

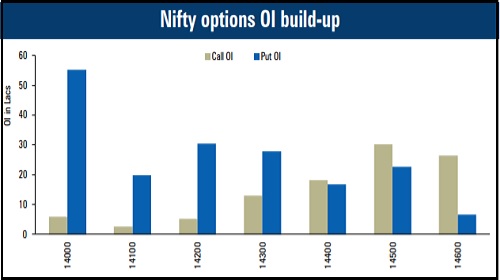

* On the data front, the Nifty has major Call base at the 14500 strike for the settlement week while the VWAP levels for the series are placed near 14600. In case of continued recovery, we believe 14600 should act as immediate hurdle for the index. At the same time, recent lows near 14200 are likely to provide immediate support to the indices on the lower side, below which declines may extend towards highest Put base of 14000

* Sectorally, as expected some short covering was experienced in the heavily beaten down stocks from the BFSI space. We expect the banking space to take the lead from here onwards in case of any recovery. Moreover, we may continue to witness some more consolidation in technology stocks in the coming sessions

* The volatility in the markets inched up last week and moved towards 23 levels. Current levels of volatility suggest a cautious sign, going ahead, and continued divergence from VWAP may bring further pressure in the market during settlement

Bank Nifty: Upside seems limited, reversal may only happen above 32500 levels…

* Volatility remained extremely high last week as broader moves were seen in the Bank Nifty. Since the past few weekly expiries, supportive actions were seen from beaten down stocks like banking and financials. However, it was unable to gauge momentum and made new lows. We feel similar action should be there for the week with upside trend reversal only being seen above 32500, which is a stiff hurdle

* A mixed bag of activity were seen from private players where supportive action was seen from HDFC Bank and Axis Bank whereas others remained muted. No major price action was there from PSU, which remained negative

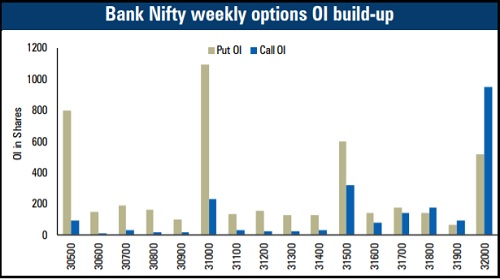

* The highest Call base for the month is now at 32000 whereas the second highest base is at 32500, which remains the strong hurdle zone. Major support are for the index is at 30500. We feel this level can be violated if the index fails to move above 32500

* Underperformance in the banking space could continue due to which the current price ratio of Bank Nifty/Nifty could move towards 2.16 levels from 2.21

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Going ahead, we maintain our positive stance and expect the Nifty to gradually head towards ...