Nifty: Momentum likely to continue towards 15500 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty: Momentum likely to continue towards 15500

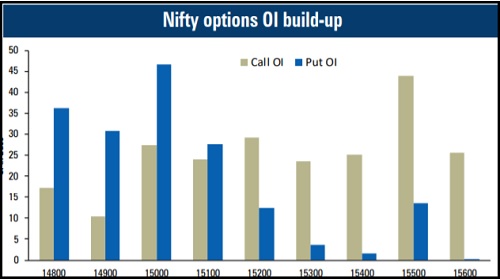

* The Nifty finally moved beyond 15000 and closed at its highest levels since mid-February. Fresh buying is seen in the banking and financial heavyweights that helped the index to move beyond its highest Call base of 15000 strike. Even midcap and small cap stocks have continued their up move and gained close to 4% each last week indicating a broad market up move. Going ahead, we expect the ongoing momentum to continue while 15400 may be achievable during settlement.

* Going ahead, sustainability of 15000 will be crucial as it was the highest Call base for the monthly settlement. From the options space, significant Put writing was experienced across strikes and 15000 Put now holds the highest Put base for the week. Hence, continued up move due to closure among Call writers is likely to be seen in the coming sessions. The immediate resistance is likely near lifetime highs of 15400 levels

* Sectorally, banking has turned the tide once again and ended the week with more than 7% returns. We expect participation from infra and FMCG stocks as well in the coming sessions

* The volatility index has moved to its lowest levels seen during the calendar year suggesting continued positive bias in the markets. In case of any extended profit booking, VWAP levels of May series near 14820 are likely to be held

Bank Nifty: Continued up move likely with support at 33500…

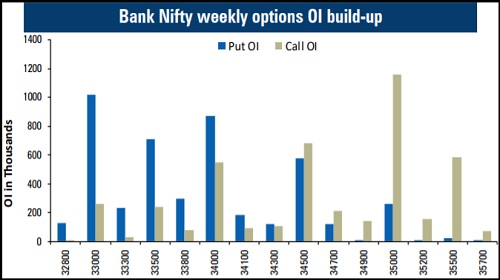

* After moving above its sizeable Call base of 33500, in the last weekly expiry, the Bank Nifty was below this level. However, it managed to gauge momentum on the last day of the week again and moved above its highest Call base of 34000. As the index moved higher shifting of positions was observed from 34000 strike to 35000 strike, which is a positive sign

* During the week, Axis Bank remained in focus due to SUUTI news. Supportive action was seen from PSU banks as well with SBI taking the lead. Due to decline in IVs, Put writing activity continued, which should provide cushion to the index

* On the options front, the Bank Nifty has the highest Call base at 34000 but the index is trading well above this level. At the same time, huge Put OI blocks were observed in 34000 and 33500 strikes. From a support prospective, we feel the Bank Nifty should hold 33500 this time in the expiry week

* Stock specific actions are expected due to rollover activity. However, we remain positive on most private banks. However, we expect non index heavyweights to continue their outperformance over heavyweights. Moreover, PSU banks are likely to continue their up trend

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Stock Picks : TCS Ltd And Chambal Fertiliser Ltd By ICICI Direct

More News

Bank Nifty trades below 42995 levels, we may see some profit booking initiating in the marke...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">