Neutral Supreme Industries Ltd For Target Rs. 2, 909 - Yes Securities

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Result Synopsis

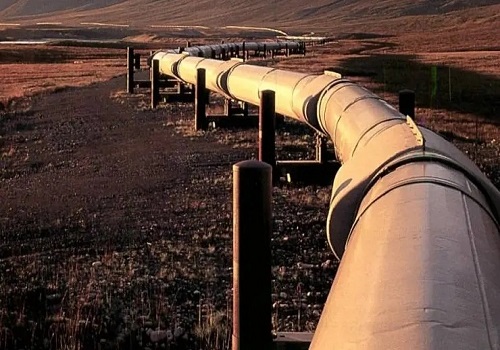

Supreme Industries Ltd (SI) reported strong set of numbers, total volumes grew by 14.6%YoY & 6.5%QoQ. On the back of healthy agri?demand & strong infrastructure demand, plastic pipe biz registered a volume growth of 16%YoY & 8%QoQ to

112,293Te (10% above our est). Inventory gains of Rs600?700Mn enabled company to register superior EBIT/Kg of Rs29.3 as compared to Rs27/16.4 in Q4FY22/Q3FY23 respectively. Other biz’s cumulative volumes increased by 9%YoY & 3%QoQ, while

revenue grew by 10%YoY & 2%QoQ for the same. For FY23, Pipe biz registered a massive volume growth of 36.7%YoY while revenue increased by 19.7%YoY on account of sharp correction in PVC resin prices witnessed during the fiscal under

review.

Management believes demand for plastic products is likely to be healthy for the industry & SI should outperform the same. Company guided for a 15% volumes growth & 10?15% growth for other segments & margins should come in at 13.5?14% for FY24.

We reckon, SI’s pipe volume to grow by 10%CAGR over FY23?FY25E & other product’s volumes to grow by 8%CAGR over similar period, on account of strong industry tailwinds driven by healthy agri?demand & robust spends in infra projects

coupled with sturdy growth in real?estate segment. Also, with PVC resin prices likely to remain range?bound, we reckon margins to normalize from FY24E. Overall we expect EBITDA margins to come in at 15.2%/15.5% in FY24E/FY25E. We have valued

the company at P/E(x) of 35x on FY25E EPS of Rs80 & incremental Rs120/share contribution from Supreme Petrochem biz, arriving at a target price of Rs2,902. Given the capped upside from CMP, we retain our NEUTRAL rating on the stock.

Result Highlights

* Revenue stood at Rs25.98Bn (14% above est), reporting a growth of 2%YoY & 12%QoQ.

* EBITDA margins came in at 18% Vs 15%/13% in Q4FY22/Q3FY23 respectively. Absolute EBITDA grew by 23%YoY to Rs4.80Bn.

* Net profit stood at Rs3.59Bn, a 11%YoY growth.

Segmental:

* Plastic pipe division: Revenue stood at Rs17.71Bn, reporting a growth of 17%QoQ & declined marginally by 2%YoY. Volumes grew by 16%YoY & 8%QoQ to 112,293Te. ASP came in at Rs158/Kg as compared to Rs186/Rs145 in Q4FY22/Q3FY23 respectively. Inventory gains of Rs600?700Mn lead to higher EBIT/kg which stood at Rs29.3 Vs Rs27/Rs16.5 in Q4FY22/Q3FY23 respectively.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">