NCDEX Mustard Seed Future price initially traded higher during the month of May - Choice Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

RM SEED

NCDEX Mustard Seed Future price initially traded higher during the month of May owing to reports of higher exports of mustard oil and rapeseed meal in the global markets. However worries of rising covid-19 cases in the Asian Countries during the second half of the last month; brought down the prices with slump domestic market. Price correction by China due to extremely high prices in agriculture and non agriculture sectors has weighed on the RM Seed prices as well. In the first week of June, prices continued to remain lower with sluggish demand for rabi crops in the domestic market. By 7thJune, NCDEX Mustard Futures has closed higher by 4.11% at Rs.7145/quintal compared to Rs.6863/quintal reported on 30th April.

For the month ahead, we are expecting NCDEX Mustard seed futures to trade bearish with the estimating of continued lower demand for Mustard Seed in the Kharif sowing season. Domestic arrivals are picking up pace as various mandis in Rajasthan, Haryana and Madhya Pradesh including the main Jaipur Mandi has reopened due to easing covid-19 cases all India. But then, various states are likely to maintain night curfew, weekend lockdown in order to curb the covid-19 cases spike until the end of June month, Lower demand for premium Mustard oil amid falling buying in China and lower exports of vegetable oil: i.e. Crude Palm Oil from Malaysia and Indonesia is expected to add pressure in RM Seed Futures. Currently the RM Seed future prices are trading in the range of Rs.7000-7100 levels, while the spot price at Jaipur Mandi is around at Rs.7200-7300 levels, which far above the MSP of Rs.4650/quintal for the year 2020-21. Sluggish overseas demand in rapeseed-meal for the month ahead could also weigh on the prices, although prices are likely to bounce back from the lower levels inthe longer duration; especially during the festive season of India.

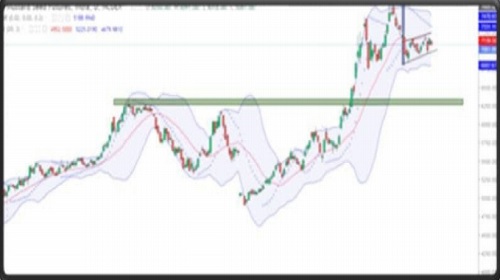

On the daily chart, after a long bullish rally, the NCDEX Mustard Seed (July) prices witnessed some correction from the higher levels, and it formed a Bearish Flag pattern which indicates a bearish reversal in the counter for the medium term. In addition, the price has also settled below the middle Bollinger Band, which also supports the bearish momentum. Moreover, the trend indicator Parabolic SAR is also indicating a bearish trend. Furthermore, on a weekly chart, the price has also formed the Evening Star candlestick, which points out a negative trend for the near future. Hence, based on the abovementioned technical structure, one can initiate a short position in NCDEX Mustard seed (July) future at CMP 7090 or a rise in the price till 7200 levels; can be used as a selling opportunity for the downside target of 6350. However, the bearish view will be negated if NCDEX Mustard seed (July) future closes above the resistance level of 7500.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://choicebroking.in/disclaimer

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">