NBFCs continue to lose market share in housing and private auto segments: Emkay Global

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

According to a report from Emkay Global Financial Services, due to lower interest rates and longer

loan tenures, customers are favouring banks over NBFCs. Recent commentary from few NBFCs about

losing market share in the private car segment to SBI is another interesting outcome. The trend of

market share losses for NBFCs to Banks is continuing, especially in housing and private auto

segments. NBFCs continue to bet on the under banked and new-to-credit segments to manage

growth momentum while also focusing on specific product segments such as used vehicle finance,

affordable housing and low-ticket MSME loans.

Credit momentum upbeat; mortgages, used vehicles and MSME loans in focus: The recent

discussions of Emkay Research with various NBFC management and industry experts point to a surge

in credit demand across sectors and geographies. New housing loans (especially in the affordable

category), used vehicle loans and MSME loans are seeing significant momentum, followed by auto

and 2Ws, while the cautious stance stays regarding unsecured loans. Demand for MHCVs and

tractors is also witnessing initial signs of a quick rebound. The introduction of the scrappage policy is

expected to accelerate used vehicle demand further.

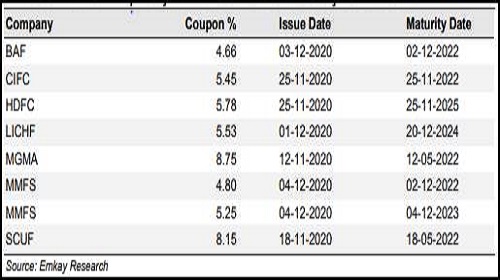

Liability profile witnessing diversity; margin improvement is here to stay: The report cited the

diversity in liability profile for NBFCs, along with surprising trends in the marginal cost of funds.

NBFCs with strong parentage, such as HDFC, Bajaj Finance and LICHF, have reported marginal

incremental cost of funds in the range of 5-5.5%, which is historical low. Recent primary issuances

data indicate that due to surplus liquidity in the system, BAF and HDFC have recently raised two-year

paper at ~4.5% (cheaper than two-year bank deposits). The shift toward MCLR-linked bank

borrowing has also aided in trimming the cost of funds. With the elevated share of fixed-rate

lending, margin improvement is expected to stay for most NBFCs. NBFC source of funds diversify

further over the last 12 months. But the borrowing from bank financing remains more or less same

in Q3FY21 vs Q3 FY20.

Liability profile witnessing diversity; margin improvement is here to stay: The report cited the

diversity in liability profile for NBFCs, along with surprising trends in the marginal cost of funds.

NBFCs with strong parentage, such as HDFC, Bajaj Finance and LICHF, have reported marginal

incremental cost of funds in the range of 5-5.5%, which is historical low. Recent primary issuances

data indicate that due to surplus liquidity in the system, BAF and HDFC have recently raised two-year

paper at ~4.5% (cheaper than two-year bank deposits). The shift toward MCLR-linked bank

borrowing has also aided in trimming the cost of funds. With the elevated share of fixed-rate

lending, margin improvement is expected to stay for most NBFCs. NBFC source of funds diversify

further over the last 12 months. But the borrowing from bank financing remains more or less same

in Q3FY21 vs Q3 FY20.

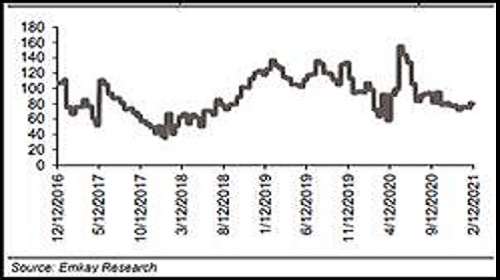

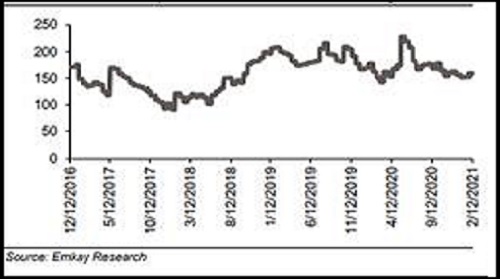

AAA NBFC spreads over G-Sec over the last 5 years

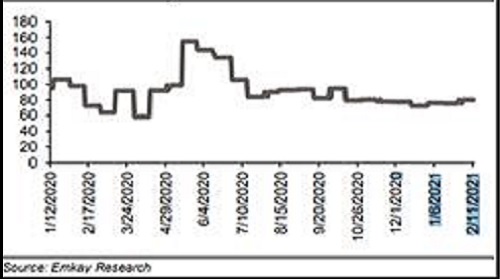

AAA NBFC spreads over G-Sec over the last 12 months

AA NBFC spreads over G-Sec over the last 5 years

AA NBFC spreads over G-Sec over the last 12 months

Recent NBFC primary issuances have been at extremely attractive rates

Asset-quality pain is not over yet; steep rise in Stage-2 assets remains a concern: Emkay Global Financial Services specifically remained concerned about the steep rise in Stage-2 assets, along with probable write-offs in Q4. Emkay Research’s discussions with NBFC management indicate that rise in Stage-2 assets is due to normalization of business after two quarters of moratorium, which is expected to ease out in the coming quarters. Also, managements are avoiding shift in portfolios from Stage 2 to Stage 3 (NPA) - also keeping overall pool of Stage-2 assets elevated. On the collection efficiency side, though collections against current month bill had seen significant improvement, collection toward arrears is still lagging for most lenders.

Restructured assets under control; ECLGS lending remains grey area: Restructuring trends have remained fairly limited for most lenders, at an average of 3-5% of AUM. Most NBFCs have given 60-180 days of principal moratorium, along with tenure extension for the restructured portfolio. ECLGS is disbursed on the basis of pre-Covid track record of customers and in a secured manner vs. a free asset. But considering one year of principal moratorium and rise in lending to existing stressed customers, it remains a grey area for now as the overall outcome of this portfolio would be visible only after some quarters.

Tightening of RBI regulations - a step in the right direction: With the RBI increasing its vigilance over NBFCs, restricting dividend payouts, etc., the research team of institutional brokerage firm believes it will result in enhancing governance structures of NBFCs, and bring more transparency and lesser leverage based growth – leading to an improvement in cost of funds and credit costs.

Emkay Global Financial Services continues to like promoter-backed, moat driven, well-governed NBFCs/HFCs with a stable liability franchise. CIFC (Buy; TP of Rs550) remains the top pick, followed by HDFC Ltd. (BUY; TP of Rs3,020) and SHTF (BUY; TP of Rs1,595). Preference also for PFC (BUY; TP of Rs210) on the back of recoveries, Atmanirbhar disbursements and improving asset quality. Emkay Global Financial Services remains watchful of BAF’s (Hold; TP Rs5,400) growth trajectory and trends in the flexi loan book.

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">