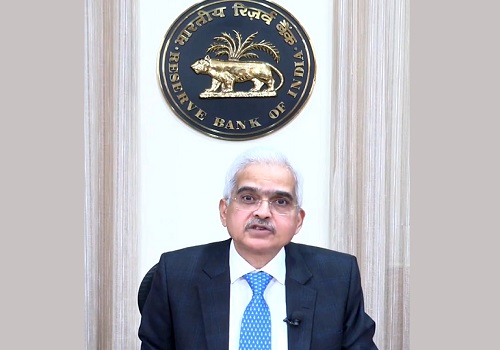

NBFCs, HFCs need to remain alert to avoid any complacency during good times: Shaktikanta Das

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Praising the Non-Banking Financial Companies (NBFCs) and Housing Finance Companies (HFCs) for their improved financial health and operational resilience in recent years, the Reserve Bank of India (RBI) Governor Shaktikanta Das has acknowledged the important role played by the sector in delivering credit to the unbanked and underserved areas.

Shaktikanta Das further advised that the NBFCs and HFCs need to remain alert to avoid any complacency during good times. The Governor highlighted the need for further strengthening the governance standards and assurance mechanisms viz. Compliance, Risk management and Internal audit in these entities.

The RBI Governor Das held a meeting on August 25, 2023 with the MD & CEOs of select large Non-Banking Financial Companies, including Government NBFCs and Housing Finance Companies in Mumbai. These Entities constitute nearly 50 per cent of the total assets of all NBFCs including HFCs.

There were discussions on diversifying the resources for NBFCs and HFCs to contain the increasing reliance on bank borrowings; risks associated with high credit growth in retail segment mostly in unsecured; prioritising the upgradation of IT systems and cyber security and strengthening Balance Sheets with improved provisioning cover.

Monitoring of stressed exposures and slippages; ensuring robust liquidity and asset-liability management; ensuring reasonableness and transparency in pricing of credit; and adherence to Fair Practices Code including robust grievance redress mechanism were also part of the agenda.

Tag News

Monthly Debt Market Update, September 2023: CareEdge Ratings

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">