Muthoot Finance Q4FY23 Financial Results

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Key Highlights

- Highest-ever Quarterly Gold Loan Disbursement: Rs. 51,850 Crores

- All-time high Gold Loan Growth in any Q4: Rs. 5,051 Crores

- All-time high Interest Collection in any Quarter: Rs. 2,677 Crores

- Total Branches as on March 31, 2023: 5,838 with 259 new branches opened during the year

- Muthoot Finance certified as ‘Great Place to Work’ for 2 nd Year in a row by Great Place to Work Institute

- Opened 67 new branches in Q4FY23

- Interim dividend for FY 23 of 220% ie., Rs.22/- per Equity Share of Rs.10/- each involving a payout of Rs.883crores.

Key Financial Highlights

- Historic Highest Growth in Loan Assets of Rs. 5,479 crores in Q4 FY23

- Historic Highest Growth in Gold Loan Assets of Rs.5,051 crores in Q4 FY23

- Historic Highest Disbursements in Gold Loan Assets of Rs. 51,850 crores in Q4 FY23

- Consolidated Loan AUM stood at Rs. 71,497 crores, up by 10% QoQ

- Consolidated Profit after Tax stood at Rs. 1,009 crores for Q4FY23, up by 8% QoQ

- Standalone Loan AUM stood at Rs. 63,210 crores, up by 9% QoQ

- Standalone Profit after tax stood at Rs. 903 crores for Q4FY23

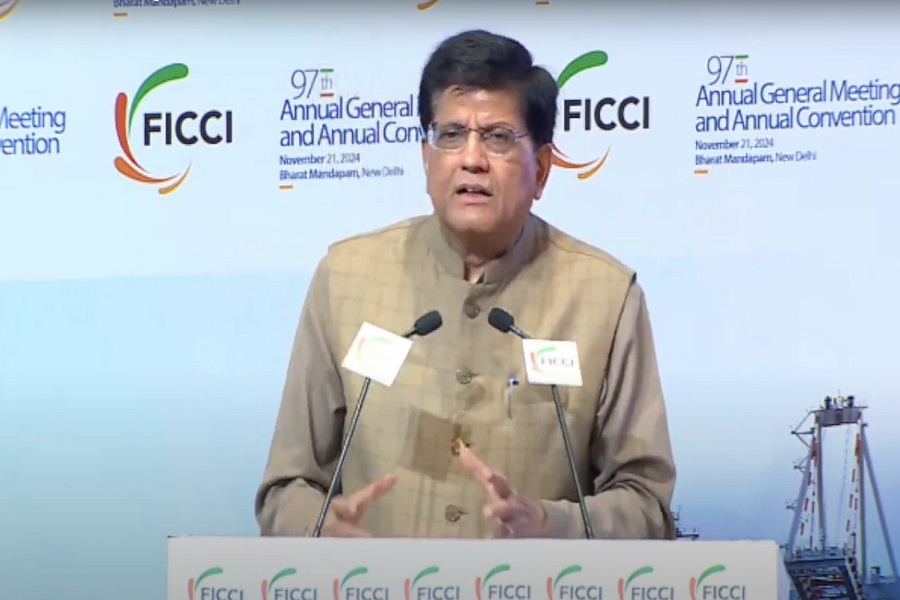

Commenting on the company’s performance, Mr. George Jacob Muthoot, Chairman, Muthoot Group said, “We achieved highest ever consolidated loan assets growth in any Q4 of Rs. 5,479 crores. Consolidated Profit after tax for Q4 stood at Rs.1,009 crores. Our vision is to remain leader in gold loan business and at the same time cater to large customer base with various loan products to meet their varied requirements. In this process, we expect to grow the loan book by 10-15% during FY 24. We continue to engage in various social projects and has spent Rs.96crores under CSR during FY23. We continue to share the profits generated during the year to our shareholders by paying an interim dividend of 220% ie., Rs.22/- per Equity Share of Rs.10/- each which involved a total payout of Rs.883crs.”

Mr. George Alexander Muthoot, Managing Director said, "The Gold Loan assets growth during Q4 FY23 of Rs.5,479 crores was the highest ever in any Q4. The disbursements also stood historic high in any Q4 at Rs.51,850 crores. Profit after tax remained steady for the quarter at Rs.903 crores. Increase in Stage 3 assets is purely an accommodation given to customers for few more months on the back of higher collateral value and we do not envisage any loss on account of the extended time. We have entered into new lending products like small business loans as well as micro personal loans. We intend to achieve calibrated growth in these new products during FY 24. We also see revival in disbursements in subsidiaries. Microfinance achieved a YoY loan growth of Rs.1,827crores. Housing Finance business achieved a QoQ loan growth of Rs.28 crores Vehicle finance business achieved a disbursement of Rs.24 crores in Q4 FY23 as against Rs.20crores during 9M FY23.

Key Subsidiaries -“Growth now revived” Muthoot Homefin

- Muthoot Homefin disbursements jumped growing at 106% YOY from Rs.84 crores in FY22 to Rs.173 crores in FY23.

· Significant jump of 153% in disbursements during Q4 FY23 (Rs.84 crores) when compared to (Rs.33 crores) in Q3 FY23.

· We plan to grow disbursement by 400% in FY 24 as per compared to FY23.

· We plan to expand our branch network by opening 26 new branches across states in FY24.

· Focus on strengthening our distribution channel i.e DSA & Connectors empanelment PAN INDIA.

· Our Sales Manpower count as on today stands at 230 employees which is 50 % increase from FY22 end. And we plan to take this count up-to 600 by Q3 FY24 end.

Belstar Microfinance

· Company crossed Rs.6192 crores Loan AUM as of March 2023 , Net worth Crossed Rs.1,000 crores and Total Revenue crossed Rs.1,000 crores, YoY growth of 42%

· Collection efficiency remaining 99% for regular accounts.

· Profit after Tax for the Company reported at Rs.130 crores , YoY Growth of 189%

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">