Multi-Asset perspectives July 2020 - Principal Asset Management

Highlights

Macro

* The flattening of the COVID-19 curve was halted, at least temporarily with a rise in new cases in US and EMs.

* Economic recovery gathered pace. Global manufacturing PMIs jumped, financial conditions eased yet again, and economic surprises clocked a second successive positive month.

* Global inflation dropped, as anticipated by our leading indicator. Inflation should bottom out soon and start rising

* Implied and realized cross-asset volatility were near their long-term averages, drawing risk-based capital into markets.

Valuations

* US Treasuries remained super expensive; IG spreads approached fair value while HY spreads remained cheap.

* Earnings cuts and price recovery in April-June made it a V-shaped valuation move for equities, pushing them well into the expensive zone. Value cheapened further vs. Growth. Asia & EM valuations improved relative to US.

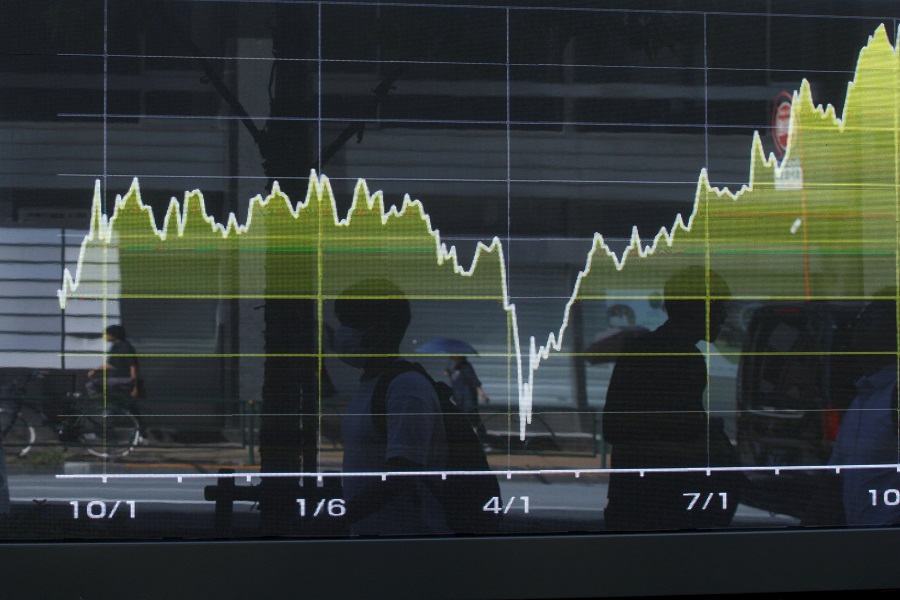

Market

Multi-Assets: Our global multi-asset index (details here) returned 2.5% as risk assets recovered further. 20 drawdown narrowed to -3.9%. Asset-class correlations remained high, limiting diversification benefits.

Global equities continued to march higher in a V-shaped pattern. 35 out of 40 markets clocked gains, with a median local currency return of 2.8% 20 drawdown to -13.4%. While US had a rare month of underperformance relative to Europe and EMs, Growth and Technology continued to outperform

Fixed income: -5bps to yet another all-time low of 0.98%. DM policy rate ended at -0.02% and EM policy rate at 2.62% (both at all-time lows). Global 10-yr yields were stable. Returns from spread products remained strong, in both absolute terms and relative to treasuries.

* Currencies: The US$ weakened for a third straight month on better orientation towards risk. Expensive valuations and declining yield advantage raise the hurdle for further sustained $ appreciation but political risks and COVID-19 related uncertainty could keep it supported.

* Commodities: The GS commodity index was helped to a gain of 6 (-25 , powered by energy and copper.

Key risks

* Failure to contain the spread of COVID-19 leading a halt in return to work strategies.

* Monetary/fiscal policy support is withdrawn too soon.

* The US election cycle starts creating political noise (dysfunctional Congress and US-China relationship under strain as China becomes a focal point). Also, a democratic control of all 3 branches of the Govt. will almost certainly cause corporate taxes to rise. Historically, a clean sweep has yielded weaker results than a divided power set-up.

* From a longer-term perspective, Govt intervention in allocation of resources will come with strings attached. Laws could be tightened around buybacks, distributions, leverage etc.

* Social stress caused by COVID-19 could manifest itself in unanticipated ways including bouts of unrest, which could dampen the recovery. Also, prolonged unemployment payouts could disincentivize workers from returning to work, impacting potential labor supply.

COVID-19 Chartbook

* Global infections rose 70% to 10.5million at the end of June. Europe and HK curves remained flat but US and Emerging Markets (EMs) showed a spike. The 7-day average of daily new cases jumped to 173k from 110k last month. US cases jumped to 41k and EMs to 70k. Part of the reason for the rise in cases was increased testing and part of it was higher incidence (positive rate) as return to work strategies were implemented. The 7-day infection rate as % of total infections was at 1.8% (unchanged from the month prior).

* Global Fatalities rose 37% to 510k from 372k. However, the fatality rate eased to 4.9% from to 6% of infections. Among populous countries, India (3%) was among the lowest. Mexico (12%) was the highest which could be due to under-reporting of cases. US was at 4.8%.

* Global Recoveries rose at a much faster pace than new cases, rising 102% to 5.3 million. As percentage of infections, they rose to 51% from 43%.

* Our Global Stringency Index, using Oxford data was at 66 from 70 versus a peak of 75 (100=highest stringency). Almost all regions showed a drop: US from 73 to 69, EMs from 81 to 78. There is little doubt that economic activity needs to be brought back to normalcy else governments will soon run out of resources to cap the downside, plunging the world into a deep economic chaos.

* Medical progress to find a solution to defeat the coronavirus continued. While Gilead started marketing its drug Remdisivir, vaccines being developed by Pfizer and Oxford are showing encouraging results. A vaccine by the end of the year looks a distinct possibility.

To Read Complete Report & Disclaimer Click Here

Above views are of the author and not of the website kindly read disclaimer

More News

JM Financial AMC announces appointment of additional non-executive director and key personnel