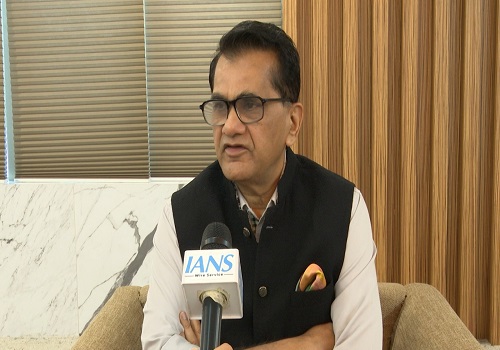

Morning Nifty, Derivative and Rupee Comments as of 09 December 2022 By Anand James, Geojit Financial Services

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Views On Morning Nifty, Derivative and Rupee Comments as of 09 December 2022 by Anand James - Chief Market Strategist at Geojit Financial Services.

Nifty outlook:

Upswings appeared more resolute yesterday, even though they got entangled in the 18,620-80 congestion resistance marked yesterday. Breaching of the same will sound a stronger signal that bears are losing grip and that 18,840 could also be overcome, but the 19,400 play needs more confirmation. Inability to float above 18,720 after the initial upswings will signal that the trend is retiring into a sideways zone again.

Derivative:

Nifty weekly contract has highest open interest at 18,650 for Calls and 18,600 for Puts while monthly contracts have highest open interest at 19,000 for Calls and 18,000 for Puts. Highest new OI addition was seen at 18,650 for Calls and 18,600 for Puts in weekly and at 19,000 for Calls and 18,300 for Puts in monthly contracts. FIIs increased their future index long position holdings by 3.53%, increased future index shorts by -4.65% and in index options by -29.56% in Call longs, -22.80% in Call short, -51.85% in Put longs and -18.68% in Put shorts.

USD-INR outlook:

The push higher yesterday lacked momentum, which is in line with our sideways expectations. A pull back is now in order, but expect 82.17 to see dips slowing down and reattempt longs. We will look for a break beyond the 81.9-82.32 band for further directional cues.

Above views are of the author and not of the website kindly read disclaimer