Metal prices did get support from market participants although updates related to vaccine - Motilal Oswal

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

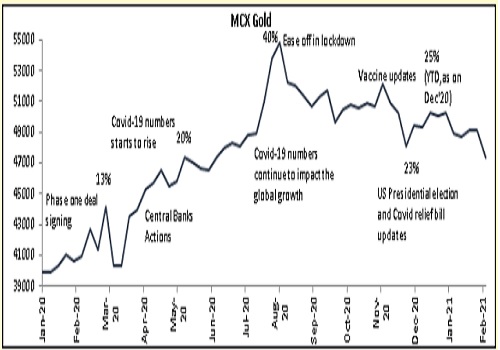

Gold prices rallied for much for 2020, marking an all-time high of ~$2080 in August. The year was rocked by the pandemic that led to economic restrictions and fiscal stimulus measures, boosting the precious metals appeal, as a safe haven investment.

Soaring debt in major economies and monetary & fiscal lending leading to increase in money supply, along with the heightened fear due to the pandemic are few of the top factors for gold's rise. Many of the reasons are expected to lift the prices this year as well, along with uncertainty of how the economy is going to recover and how fast and large the recovery will be coupled with increasingly historical levels of fiscal aid, will create a strong floor for the metal prices.

The expectation for more government aid under the Biden administration -- which has proposed a massive $1.9 tln rescue package in addition to the $900 bln already enacted by Mr. Trump last month, has increased optimism in market.

To support Covid impacted economy, major economies have announced trillions of dollars as liquidity measures, which supported bullions. Along with President Biden, Janet Yellen Treasury Secy is also in favor of additional liquidity measures, this scenario is not very good for economy as it will increase debt and impact inflation, but will create a beneficial environment for bullions.

The first Fed meeting of the year took place against a backdrop of potential congressional gridlock as Democrats and Republicans bicker over the new fiscal stimulus package, impeachment trial of former President Donald Trump, and even how an evenly divided Senate will conduct its business.

The Fed held its main interest rate close to zero and its asset purchases steady as Governor Powell warned that the battle against the economic fallout from the pandemic was far from over, which hence supported the bullions on the lower levels. Fed continued to maintain accommodative stance until inflation runs moderately above 2% for some time. Apart from lending facilities which have been extended till Mar, Fed will also continue to buy $120 bln of debt a month until "substantial further progress" had been made in recovery.

Looking at reasons mentioned above gold and silver do have stronger fundamentals which would continue to support prices in future. Government of India in their 'Union Budget 2021' announced a reduction in Gold and Silver import duties from 12.5% to 7.5%, but effective rate is approx. 10.75%( calculation is mentioned in the table). Domestic import duties were quite steep and there was a growing need for duty cuts from various participants.

Outlook:

Metal prices did get support from market participants although updates related to vaccine and volatility in dollar and yields capped some gains for the precious metal pack. It will be important to see now that how well in sync does the Biden Administration and the Fed work.

And will they use any other tools as well to support the economy and control yield and dollar volatility, are important to keep in mind for the future. Market participants are very optimistic w.r.t. their new leader. Policies and promises by President Biden are very progressive, also talk about additional fiscal stimulus by him and his team is supporting overall market sentiment.

This excess liquidity definitely creates hint of concern for spillover effect in future, but necessary to support and escape from current situation. Duty cuts in Budget'21 will negatively impact prices although above mentioned fundamentals and uncertainties would continue to create a strong floor.

Gold prices have consolidated over the last few months and recently corrected towards $1800 on the COMEX where we are comfortable buying for a short to medium perspective targeting new life time highs towards $2150. On the domestic front, the post budget prices correction is a good level to enter once again for an upside towards new highs of Rs.56,500 and above over the next 6 months.

To Read Complete Report & Disclaimer Click Here

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html SEBI Registration number is INH000000412

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">