Meanwhile some tentativeness could be sensed until the unfilled gap of 17820 - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

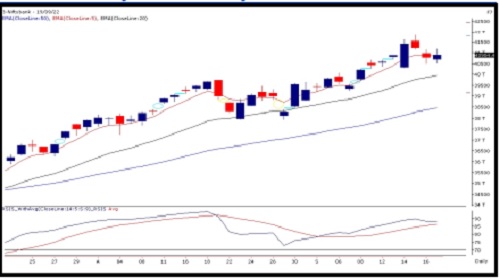

Sensex (59141) / Nifty (17622)

The weakness in the global market led to a mild start in Indian equities, wherein the benchmark index started the session on a nervous note. Soon after, the bulls grabbed the opportunity and made a modest recovery in the index, post which slender rangebound moves were seen throughout the day. Amidst the lackluster session, the bulls showed their resilience and snapped the losing momentum of the past three days. The Nifty concluded the day with a gain of 0.52 percent and settled a tad above the 17600 level.

We allude to our previous commentary on the market being tentative amid uncertainty in the global bourses. However, the undertone is expected to remain upbeat till Nifty sustains above the unfilled gap of 17400-17380 odd zone. Meanwhile, some tentativeness could be sensed until the unfilled gap of 17820-17860 is not taken out. Looking at the technical setup, the market is likely to trade within the mentioned range until a decisive breakout is not seen on either side in the comparable period.

Nifty Bank Outlook (40904)

Bank Nifty as well started on a weak note however post the initial dip towards Friday's low a strong bounce back was seen during the first hour. There was no major traction after that, and the bank index remained within a range throughout the session to end with gains of 0.31% tad above 40900.

The bank index continues to consolidate within the strong bullish candle formed on Wednesday 14th September. The low of this candle at 40288 is a very sacrosanct level as if broken can trigger the bearish Shooting Star pattern formed last week on the weekly chart. As long it holds the primary trend remains positive and any dips should be considered buying opportunity. On the higher side, 41500 - 41840 is the stiff resistance zone. For the Shooting Star pattern to neglect and to trigger the positive momentum back, the Bank Nifty needs to close above 41840. Traders are hence advised to keep a tab on the mentioned levels and since the volatility is likely to be on the higher side avoid being complacent.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">