Markets to rally in the short term

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Markets were under severe pressure and lost sharply during the last week. They lost on all the five days of the week gone by. At the end of it all, BSESENSEX was down 2,041.96 points or 3.72 per cent to close at 52,793.62 points. NIFTY was down 629.10 points or 3.83 per cent to close at 15,782.15 points.

The broader markets saw BSE100, BSE200 and BSE500 lose 4.44 per cent 4.62 per cent and 4.81 per cent. BSEMIDCAP lost 5.68 per cent while BSESMALLCAP lost 6.56 per cent. Very clearly there was pain across the board and stocks of all kinds were under pressure. The lows made in the market a fortnight after the Russia-Ukraine war began on February 24, were made on 7-8th March. These lows were almost tested during trading over the last couple of days. Though they have held ground this time around, there is no guarantee that they would hold ground on the next such retest.

The Indian Rupee was under pressure against the US Dollar and lost 53 paisa or 0.69 per cent to close at Rs 77.45. Dow Jones lost on four of the five trading sessions and managed to recover some ground during trading on Friday. Incidentally, Dow made a new 52-week low during the course of trading on Thursday at 31,228 points. Dow Jones lost 702.71 points or 2.14 per cent to close at 32,196.66 points. It now trades with losses of 11.40 per cent on a year-to date-basis.

The week gone by saw the issues from LIC, Delhivery, Venus Pipes and Prudent Corporate Advisory tap the markets and close. Life Insurance Corporation of India Limited was oversubscribed 2.95 times and received 73.37 lakh applications which is a record by itself. The shares of LIC would list on Tuesday, the 17th of May.

The issue from Delhi very Limited was subscribed 1.71 times with QIB portion subscribed 2.80 times, HNI portion undersubscribed at 0.32 times, Retail portion undersubscribed at 0.60 times and even employee portion received subscription of just 0.29 times. The issue which included a fresh issue of Rs 4,000 crore and an offer for sale of Rs 1,235 crore garnered subscription of Rs 7,300 crore or 1.39 per cent of the issue size, including anchor portion. What was revealing is the fact that except for the QIB portion, all other buckets of HNI's, Retail and Employee were undersubscribed. It clearly explains the apathy shown by non-institutional investors to anything labelled as related to technology.

The nest issue was from Prudent Corporate Advisory Services Limited which was subscribed 1.22 times. Here the QIB portion was subscribed 1.26 times, HNI portion 0.99 times, Retail portion subscribed 1.29 times and Employee portion subscribed 1.23 times. The issue was an OFS for Rs 538 crore.

The next issue was from Venus Pipes and Tubes limited. This issue was subscribed 16.30 times overall with QIB portion subscribed 12.02 times, HNI portion 15.69 times and Retail portion was subscribed 19 times. In an issue where the retail portion was about Rs 50 crore, there were 6.28 lakh forms while the retail portion of Delhivery which was for Rs 520 crore received a mere 1.73 lakh forms. Very clearly Retail knows what to do.

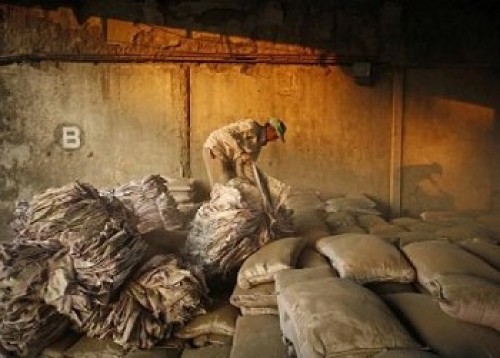

The week ahead sees the IPO from Paradeep Phosphates Limited tap the markets with its fresh issue of Rs 1,004 crore and an offer for sale of 12 crore shares in a price band of Rs 39-42. The issue opens on Tuesday the 17th of May and closes on Thursday the 19th of May. The issue size is about Rs 1,508 crore. The government of India would be exiting its stake entirely in Paradeep Phosphates post this issue. The company completed its allocation to anchor investors on Friday which consists of 68 per cent to domestic mutual funds and the balance to FII's.

The company is a manufacturer and trader of complex fertilisers which are non-urea in nature. Its main products include DAP and NPK. As part of its backward integration, it makes its own phosphoric acid and is adding capacity of the same so that it becomes an even more effective cost producer. The company reported an EPS of Rs 6.30 for the nine months ended December 2022. At this EPS, the PE multiple of the share is more than attractive with the PE band based on nine months non annualised being 6.20-6.67. This is very attractive when compared to peer group like Coromandel, Chambal and Deepak Fertilisers who trade between 11.57-18.72 times. The main object of the issue is to acquire on a slump basis the plant of Zuari Agro in Goa. This issue is more than attractively priced.

The second issue is from Ethos Limited which is a luxury and premium watch retailer in India. The issue consists of a fresh issue of Rs 375 crore and an offer for sale of 11.08 lakh shares in a price band of Rs 836-878. The issue opens on Wednesday the 18th of May and would close on Friday the 20th of May. It is India's largest retailer and currently has 50 stores through which it sells its products. It has now also tied up with a jewellery brand Messika and an international luggage brand, Rimowa to further grow its business. The company runs an omni-channel distribution model and has a loyalty program as well. The company reported an EPS of Rs 8.74 for the nine-month period ending December 2021. The PE band at the above 9-month non-annualised EPS would be 95.65-100.45. Valuations are not cheap and investment is meant for the classy investor.

Coming to the week ahead, expect markets to rebound sharply in the coming week. There has been a sell-off and positions in small and midcap stocks have been ruthlessly hammered. Notwithstanding that FII's continue to remain sellers, expect some sanity in the short term at the bare minimum. Markets should attempt to recover to a bare minimum of 16,350-16,550 before deciding the next course of action. This part of the rally could be volatile and vicious like the fall that was witnessed. Remember that the correction is not over but could happen again after the rally. Trade cautiously and keep light positions at the end of day.

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">