Markets remained volatile and lost over half a percent, tracking feeble global cues - Religare Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Nifty Outlook

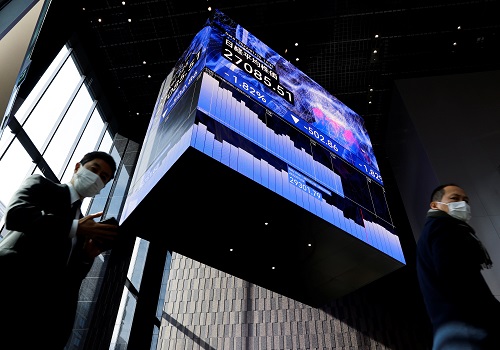

Markets remained volatile and lost over half a percent, tracking feeble global cues. The news of the escalation of the Russia-Ukraine issue triggered a sharp reaction in the early trade, in line with global markets. However, gradual recovery in select index majors trimmed losses as the session progressed. Consequently, Nifty settled at 17.092.20 levels; down by 0.7%. All sectoral indices ended lower wherein realty, oil&gas and capital goods were among the top losers. The selling pressure remained high on the broader front wherein both midcap and smallcap ended lower by 1% and 2% respectively.

The escalation of tension between Russia-Ukraine has severely dented sentiment globally as participants were hoping for resolution through talks. They are now eyeing how Ukraine would retaliate and the reaction of the global markets, if the US imposes sanctions on Russia as stated before. We reiterate our cautious view and suggest limiting the leveraged positions. On the index front, a decisive break down below 16,800 in Nifty could result in a fresh fall else choppiness would continue in a range.

News

Dhunseri Tea & Industries has informed exchanges that it sold Santi Tea Estate to Mis Sri Shyam Santi Tea. It entered into an agreement for sale with Mis Sri Shyam Santi Tea for sale of the said tea estate excluding its tea manufacturing factory. The possession of the said tea estate has been handed over.

Marksans Pharma announced that UK MHRA has granted Market Authorisation to the company's wholly owned subsidiary Bell Sons & Co. (Druggists) Limited for Bells Healthcare All in One Oral Solution.

Krsnaa Diagnostics announced that the company won a tender from the Himachal Pradesh government.

Derivative Ideas

HEROMOTOCO MAR FUTS gained 1.14% and closed at 2751.95 on 22nd Feb. The stock has shown good up move intraday after taking the support at 2640 -2660 levels. Now closing above its important 10 Day EMA, the counter is poised to test its resistance at 2800 levels. We recommend to go Long in HEROMOTOCO MAR FUTS.

Strategy:- BUY HEROMOTOCO MAR FUTS @ 2720-2730, SLOSS AT 2690, TRGT 2800.

Religare New Year Pick - INOX Leisure Ltd.

Incorporated in 1999 and part of the INOX Group, INOX Leisure Ltd. (INOX) is the second-largest multiplex chain operator in India. The company’s screen additions have grown multi-fold over the past 10 years, from 91 screens in FY09 to 667 screens currently (Q3FY22 end) having a wide presence in ~70 cities with a seating capacity of 1,50,000+. We like INOX in this space given its focus on enhancing the consumer experience, continued emphasis on expansion, effort on increasing spending per head, and increasing footfalls. We recommend a Buy on the stock and arrive at a target price of Rs. 495 (target EV/EBITDA multiple of 13x). Some of the key risks to our estimates include a) resurgence in COVID cases and b) slower than expected revival in footfalls.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.religareonline.com/disclaimer

SEBI Registration number is INZ000174330

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...

More News

Indian markets closed on a positive note where buying was mainly seen in Cement, Banking, Au...