Market was not done yet, in fact the exuberance level kept on rising as the week - Angel Broking

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Sensex (50732) / Nifty (14924)

The year 2020 was full of unprecedented things; but 2021 also seem to be following the similar footsteps. Fortunately, it surprised us pleasantly as Finance Minister stood by her words and really presented ‘Like never before’ Union Budget on Monday. Since the market had lightened up ahead of the event, market participants had all the reason to grab this opportunity with both hands and hence, we could see a gargantuan move to clock probably biggest gains ever on the budget day.

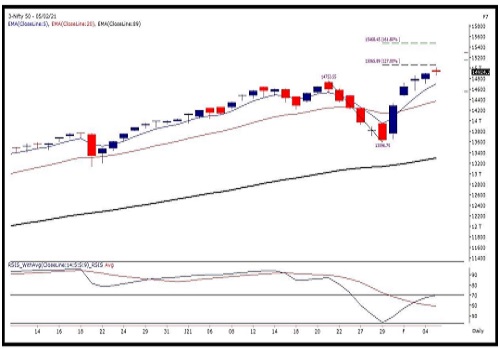

Market was not done yet, in fact the exuberance level kept on rising as the week progressed to clock one of the biggest weekly gains to register new high tad above the magical figure of 15000. Who would have thought during the previous weekend (especially after having a terrible week of trade), Nifty and other major indices would have such a mesmerizing rally to reach record highs so soon.

Many would be claiming now but practically, there would be hardly anyone who could have anticipated this. Honestly, we expected Nifty to move towards 14000 – 14200 but not beyond considering the previous week’s price action. But the way it conquered 14200 with some authority, there was no doubt left after Monday’s session, we are heading towards record highs.

The real charioteer of this spellbinding move was the financial space. Some of the banking giants took off during the week as if there is no tomorrow. Now, markets have hastened towards their near term targets with this fast and furious rally so soon. Hence, it would be interesting to see how it behaves in this week. As far as levels are concerned, 15050 – 15200 – 15400 are the important Fibonacci levels in the upward direction; whereas on the lower side, 14700 – 14500 are to be seen as key supports.

Although, the banking stocks have seen rarest weekly spurt during the week, some profit booking was witnessed on Friday after a marathon rally. This led to a formation of ‘Gravestone Doji’ pattern on the daily chart of BANKNIFTY. The said pattern needs confirmation of price trading below the low of the candle i.e. 35545 in this case. If this happens then we would probably see some profit booking in this week. Traders should take a note of this and ideally it’s advisable to follow stock centric approach.

Nifty Daily Chart

Nifty Bank Outlook - (35654)

On Friday, the Bank Nifty started with a huge gap up opening and the upmove extended towards 36615. However, post the RBI policy the bank index gradually came lower to erase around 1000 points from the morning highs to eventually end with gains of 0.88% at 35654.

It was certainly a mesmerizing week for the banking and financial space as the bank nifty moved from is previous week close of 30565 to intraweek high of 36615 and to eventually end with whooping gains of 16.65%. Now due to this strong move the oscillators were in deep overbought territory and hence we witnessed some profit booking during fag end resulting a gravestone doji on the daily chart.

For the coming next few sessions if prices sustain below the low of the mentioned doji pattern at 35545 we may see some price correction in the bank index. In such scenario, 34980 - 34500 will be the immediate support. On the flip side, 36000 and 36615 is the immediate resistance zone. Traders are advised to continue with stock specific opportunities that are likely to give outperforming opportunities.

Nifty Bank Daily Chart

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://trade.angelbroking.com/Downloads/ARQ-Disclaimer-Note.pdf

SEBI Registration number is INH000000164

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

On the higher side, immediate resistance is seen around 36000 - 36200 levels - Angel One

More News

Opening Bell: Markets likely to make optimistic start on positive cues from other Asian markets