Market participants were hoping for some aid from this event and RBI Governor - Angel One

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

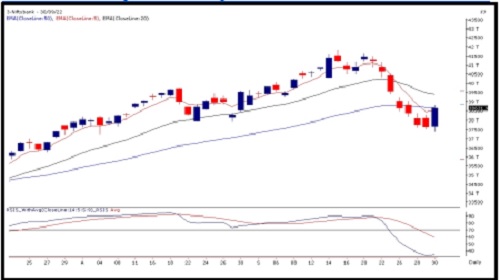

Sensex (57427) / Nifty (17094)

On Friday, market had a litmus test ahead of the RBI Monetary policy as the Nifty was placed slightly below key support of 16800. Market participants were hoping for some aid from this event and RBI Governor did not disappoint this time as we not only witnessed a V-shaped recovery post the policy; but also went on to reclaim 17000 with some authority.

With Friday’s smart rally, Nifty almost engulfed entire week’s traded down move and hence, restricted the weekly losses tad above a percent. Markets were extremely oversold, but they were reluctant to rebound as global weakness persisted throughout the week. Post the RBI Monetary policy, we have managed to reverse precisely from a key support zone and if global markets support, we may see this relief getting extended in this week as well. Technically speaking, the daily time frame exhibits a ‘Bullish Engulfing’ pattern and on weekly chart, ‘Dragonfly Doji’ is clearly visible. Importantly, Nifty managed to defend the ‘20-EMA’ (on a closing basis) on weekly chart, which is an indication of some strength. Going forward, a move beyond 17200 on a closing basis would strengthen the recovery rally. In this case, 17350 – 17500 levels cannot be ruled out. On the flipside, 16900 – 16750 has now become a sacrosanct support zone for the bulls.

Nifty Bank Outlook (38632)

The banking space struggled the whole week amid the global selloff, but in the last trading session post the MPC outcome the overall sentiments turned around. In tandem with the benchmark index, the BankNifty index settled the week on a negative note but has pared down losses of the last three sessions, which construes as a positive development. With all the hustles throughout the week, Bank Nifty settled a tad above 38600 levels, with a cut of 2.31 percent on the weekly basis.

On the technical aspect, although, the banking index has settled in red for the second consecutive week, the weekly chart now depicts a ‘Hammer’ candlestick pattern due to Friday’s smart rally. And as it has formed in the oversold market condition as well as at ’20- week EMA’, one should not overlook its significance from the technical perspective. As far as levels are concerned, 37500-37380 are to be considered as key support levels. On the flip side, the unfilled gap of 39230-39420 odd zone is likely to be seen as an immediate hurdle, breaching which the index is expected to reclaim the 40000 mark in the comparable period.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.angelone.in/

SEBI Regn. No.: INZ000161534

Above views are of the author and not of the website kindly read disclaimer

Tag News

Quote on Silver : Silver price falls in recent weeks Says Prathamesh Mallya, Angel One

More News

Nifty opened with an upward gap but witnessed selling from the opening tick to end negative ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">