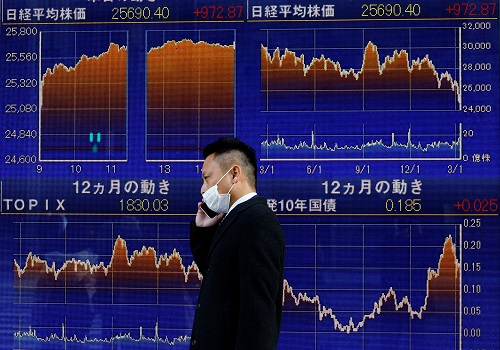

Market is expected to open on a flattish note and likely to witness sideways move during the day -Nirmal Bang

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

US: Stock market indexes recovered from larger losses but still closed in the red in Thursday's session.

Asia: Asia-Pacific markets were mixed as banking fears were reignited on Wall Street, sending the three major U.S. indexes into a four day losing streak

India: The key Indian indices started the day on a jittery note after the US Federal Reserve hiked interest rates by another 25 bps, on expected lines. The benchmarks, however, soon steadied and moved from strength-to-strength on the back of strong corporate earnings and renewed FII buying. A possible pause by the US Fed in rate hike also aided the sentiment.

Market is expected to open on a flattish note and likely to witness sideways move during the day.

Global Economy: China's service activity grew for a fourth straight month in April, a private-sector survey showed on Friday, as businesses continued to benefit from a return toward pre-pandemic levels of demand and output, although expansion slowed slightly. The Caixin/S&P Global services purchasing managers' index (PMI) fell to 56.4 in April from 57.8 the month prior, above the 50-point mark that separates expansion and contraction in activity on a monthly basis.

Australia's central bank on Friday warned that risks to inflation were on the upside given low productivity growth, rising energy prices and a surge in rents as population growth out paces all expectations. In a quarterly Statement on Monetary Policy, the Reserve Bank of Australia (RBA) reiterated that interest rates might have to rise further to restrain inflation, having stunned markets this week with its 11th hike to 3.85%.

Commodities: Gold prices hovered below record highs on Friday as traders locked in a measure of recent profits, with markets remaining cautious ahead of key U.S. labor data that is widely expected to factor into monetary policy.

Oil prices steadied on Friday, but were set for their worst weekly drop in nearly two months amid fears of slowing U.S. economic growth and a softer-than-expected rebound in Chinese demand.

Currency: The yen was eyeing its first weekly gain in nearly a month on Friday, driven by safe haven demand as bank sector turmoil in the United States unfolds, while the dollar fell as traders priced in more aggressive rate cuts from the Federal Reserve.

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH000001766

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer

Tag News

Weekly Market Analysis : Markets strengthened recovery and gained nearly 2% in the passing w...