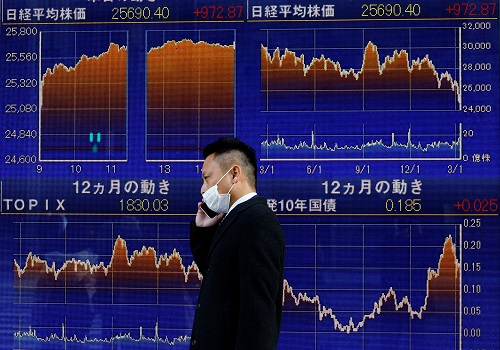

Asia stocks skid as Ukraine war, China's COVID surge weigh

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

SYDNEY (Reuters) - Asian stocks were in the red on Tuesday as surging COVID-19 cases in China hit the confidence of investors who are already worried about the Ukraine war and the first U.S. interest rate rise in three years, which could come this week.

MSCI's broadest index of Asia-Pacific shares outside Japan was down 1.91%, led by Chinese stocks. The index is down 8.2% so far this month.

Hopes that talks between Russia and Ukraine due to resume on Tuesday could provide a resolution to the conflict prompted a sharp fall in global oil prices.

However, the fourth round of negotiations began Monday with no major progress seen, adding to the nervousness in equity markets.

During the Asian session, U.S. crude slipped a further 2.54% to $100.44 a barrel, in line with broader asset selling. Brent crude was down 2.27% to $104.42 per barrel.

In U.S trading, oil prices had fallen as much as 5.8% as prospects of a positive outcome in Ukraine talks eased concerns about major supply disruptions.

But adding to the overall negative sentiment are rising case numbers of COVID-19 in China, which investors fear will hurt the mainland's economic growth in the first quarter.

"Right now everyone is looking at the Chinese cases and realising that has to have an effect on production," said Hong Hao, BOCOM International's head of research.

"China's growth in the first quarter could be closer to zero than 5.5%. There's a ripple effect. There's Ukraine, the risk of U.S. sanctions on China and rising Chinese domestic COVID cases - it does not look good."

Hong Kong's Hang Seng Index remains mired in negative territory, dropping 3.8% early on Tuesday, following an almost 5% selloff one day earlier. Hong Kong's main board is down 17% so far in March.

China's CSI300 index was down 2.3%.

China on Tuesday reported 3,602 new confirmed coronavirus cases compared with 1,437 on Monday, according to the National Health Commission.

Investor focus is also on the U.S Federal Reserve, which meets on Wednesday and is expected to hike interest rates for the first time in three years to offset rising inflation.

Australian shares slipped 0.5% while Tokyo's Nikkei Index was marginally higher, up 0.17%.

U.S. stocks experienced a mixed session, with declining technology companies prompting most indexes to close lower Monday.

The Dow Jones Industrial Average was mostly flat, the S&P 500 lost 0.74% and the Nasdaq Composite dropped 2.04%.

The yield on the benchmark 10-year Treasury notes rose to 2.1419% compared with its U.S. close of 2.14% on Monday.

The two-year yield, which rises with traders' expectations of higher Fed fund rates, touched 1.865%, up from 1.849%.

Gold was also weaker in Asia with the spot price at $1,949.21 per ounce. [GOL/]