MCX gold prices are likely to rise further towards 51,850 levels due to risk aversion in global markets - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

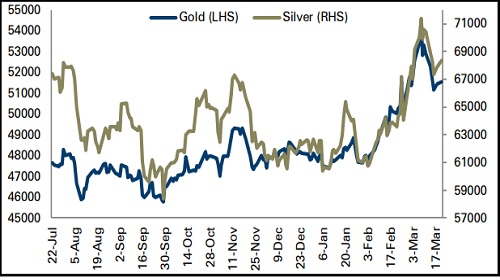

Bullion Outlook

Gold prices surged by 0.45% on Monday amid pessimistic sentiments in the US markets. Further, lack of progress in peace talks between Ukraine and Russia boosted demand for safe heaven assets

However, sharp upsides were capped by the US Federal Reserve's plan of aggressive monetary tightening measures to combat elevated inflation. US benchmark 10 year treasury yields surged to 2.24%, increasing the opportunity cost of holding non yielding bullion

MCX gold prices are likely to rise further towards | 51,850 levels due to risk aversion in global markets and on higher inflation. On the domestic front, weakness in the rupee against the dollar may continue to support gold prices on the lower side. Silver prices are expected to take cues from gold prices and move further towards | 68,850 level for the day

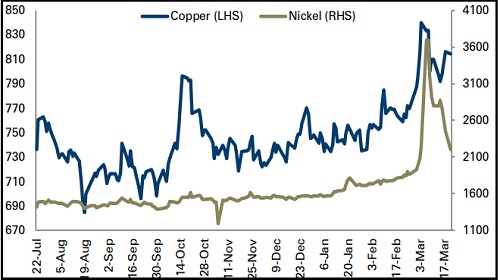

Base Metal Outlook

Aluminium prices rallied around 3.20% on Monday after Australia imposed an immediate ban on exports of alumina and aluminium ores to Russia

Moreover, Germany based aluminium maker Trimet will reduce production at its main factory in Essen by 50% in the coming weeks amid higher energy prices that have increased its cost of production

LME registered warehouse inventories of aluminium dropped to 704,850 tonnes from 752,850 tonnes over the past one week. A significant decline in inventories has continued to support aluminium prices on the lower side

MCX aluminium prices are expected to move further towards | 286 levels due to concerns over supply disruptions and on consistent decline in LME inventories. Moreover, expectations of monetary stimulus from China’s central bank may boost aluminium prices

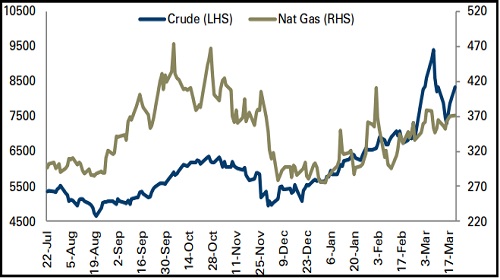

Energy Outlook

Oil prices advanced 6.22% on Monday as European Union countries and the US Biden administration have considered sanctions against Russian crude oil over its invasion of Ukraine. Further, oil prices were also boosted by supply disruptions at Saudi Arabia’s Aramco plant

According to the Saudi energy ministry and state media, on Sunday, Yemen’s Iran aligned Houthi group fired missiles at Saudi energy and water desalination facilities, which led to a temporary drop in oil output at Saudi Arabia’s Aramco plant

MCX crude oil prices are likely to trade in the range of | 8,250-8,650 levels with a positive bias due to tight supply and consistent fall in global crude oil stockpiles. Additionally, concerns over sanctions against Russia may continue to support oil prices on the lower side. However, expectations of returning Iranian oil supply may ease the global supply tightness

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">