MCX gold prices are expected to correct towards 51,000 level - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

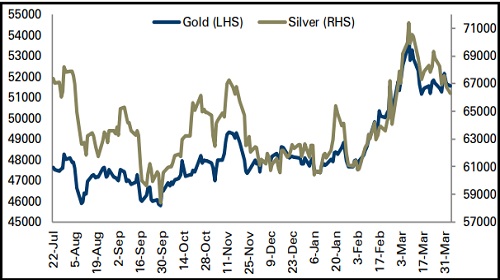

Bullion Outlook

• Comex Gold prices surged 0.47% on Monday amid unsatisfactory macroeconomic data from the US and on concerns over elevated inflation. Moreover, investors were worried about more sanctions against Russia over its invasion of Ukraine, boosting the demand for safe haven assets

• However, a sharp rise in the US dollar index and rebound in US bond yields capped further upsides in bullion prices

• MCX gold prices are expected to correct towards | 51,000 level for the day due to optimistic sentiments in the global markets and stronger dollar. However, concerns over the Russia-Ukraine crisis may prevent further downsides in gold prices. Silver prices are expected to take cues from gold prices and slip further towards | 65,700 level for the day. Additionally, investors will remain cautious ahead of Fed member Brainard’s speech scheduled today

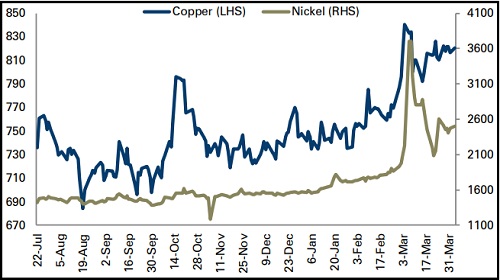

Base Metal Outlook

• MCX Aluminium declined 1.71% on Monday, mainly due to an uptick in the dollar index and disappointing factory orders data from the US raised concerns about the industrial metal demand

• US Commerce department said on Monday that factory orders fell 0.50% in February, the lowest since April 2021 amid higher raw material cost and shortages of materials

• However, significant decline in LME inventories of aluminium prevented further downsides in aluminium prices

• MCX aluminium prices are expected to slip further towards | 274 level for the day due to demand concerns and stronger dollar index. However, supply disruptions from Russia and lower stockpiles may continue to support the prices on lower side. Additionally, market participants will keep an eye on a series of macroeconomic data from the US

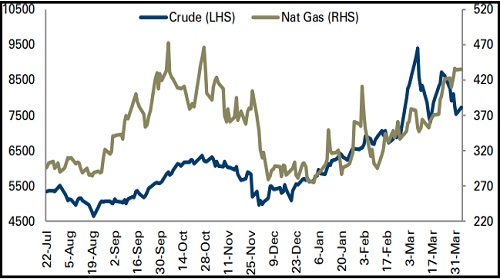

Energy Outlook

• Nymex crude oil prices rebounded 2.21% on Monday as investors feared about tighter supply amid Western countries set to impose more sanctions on Russia's energy sector

• Saudi Arabia has increased its May official selling price (OSP) to Asia for its Arab Light crude to $9.35 from $4.40, which boosted oil prices

• Additionally, oil prices also gained support from a pause in talks in Vienna to revive the Iran nuclear deal, which would allow a lifting of sanctions on Iranian oil

• MCX oil prices are likely to consolidate in the range of | 7,450 to 7,900 levels for the day due to delay in Iranian oil supply and concerns over more sanctions on Russian energy sector. However, higher oil supply from the US and demand concerns from China may continue to pressurise oil prices on the higher side

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Turmeric trading range for the day is 7756-7948 - Kedia Advisory

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">