MCX gold prices are expected to correct towards 52,250 levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Comex gold prices retreated 1.52% on Tuesday amid rise in risk appetite in US markets. Further, hawkish comments from US Fed officials and elevated US bond yields weighed on bullion prices

• Moreover, the dollar index surged to a two-year high amid expectations that the Federal Reserve will tighten its monetary policy in next meeting to combat the elevated inflation, making gold more expensive for overseas buyers

• However, soaring inflation and worries over the Russia-Ukraine war prevented further downsides in precious metal prices

• MCX gold prices are expected to correct towards | 52,250 levels for the day due to a firm dollar

• Silver prices are expected to take cues from gold prices and may slip further towards | 67,800 for the day

Base Metal Outlook

• MCX Copper and other industrial prices declined on Tuesday amid a stronger dollar index

• At the same time, Covid-19 lockdowns in top metal consumer China and ongoing Russia Ukraine war raised concerns about a slowdown in global economic outlook, weighing on industrial metal demand

• LME registered warehouse inventories of copper jumped to 118,825 tonnes, highest since November 2021. A significant rise in inventories has continued to pressurise copper prices on higher side

• However, better than expected building permits data from the US prevented further downsides in Industrial metal prices

• Copper prices are likely to slip further towards | 815 levels due to expectations of disappointing Existing home sales data from the US. However, supply disruptions from Russia may continue to support the prices on lower side

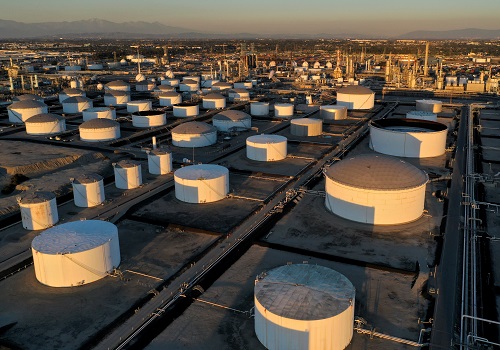

Energy Outlook

• WTI crude oil prices tumbled 5.24% on Tuesday on investor fear over fuel demand amid the International Monetary Fund (IMF) cutting its economic growth forecasts and warning of higher inflation

• Further, oil prices were pressurised by higher oil supply from global Strategic Petroleum Reserve (SPR)

• However, lower output from Libya and Russia would limit the downside of crude prices

• MCX crude oil prices are expected to trade in the consolidation range of | 8,100 to 7,750 for the day due to anticipation of higher crude oil inventories data from the US and worries over global fuel demand. However, significant decline in Opec countries oil supply and delay in removal of sanction on Iranian oil may limit the further downsides in oil prices in the near term

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Copper, Natural Gas, Silver and Zinc Commodity Report Of 26 /04/2021 - Enrich Commodities

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">