MCX gold prices are expected to consolidate in range of 50,850 to 51,400 - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

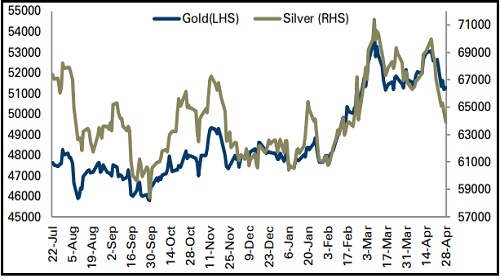

Bullion Outlook

• Comex gold prices gained marginally by 0.23% on Thursday amid disappointing Initial jobless claim and GDP data from the US

• US GDP unexpectedly contracted at a 1.4% annualised rate in CYQ1 2022 compared to 6.9% in CYQ4 2021. Growth has slowed down due to supply chain issues

• However, elevated dollar index and a sharp rise in US 10 year bond yields capped further gains in gold prices

• MCX gold prices are expected to consolidate in range of | 50,850 to 51,400 for the day due to higher inflation and concerns over Russia Ukraine conflict. However, optimistic sentiments in global markets and expectation of aggressive monetary policy tightening by the US Fed may hurt gold prices. Silver prices are expected to take cues from gold prices and trade in the range of | 63,500 to 64,400 levels for the day

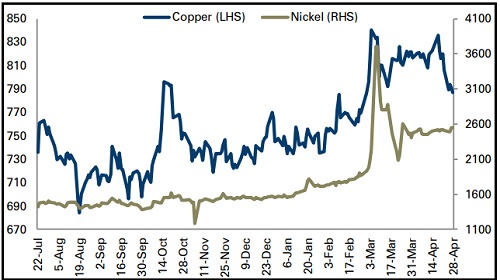

Base Metal Outlook

• LME Copper and other industrial metal prices retreated on Thursday due to a stronger dollar index and as growing worries over industrial metal demand amid continued Covid-19 lockdown restrictions in China

• At the same time, LME registered warehouse stockpiles of copper rebounded to 150,850 tonnes from 137,775 tonnes over the last week. A significant increase in inventories weighed on copper prices

• MCX Copper prices are expected to correct towards | 775 levels for the day due to concerns over slowing global economic outlook. Further, rising LME inventories and an uptick in dollar index may continue to pressurise the copper prices on pullback. Additionally, investors will keep an eye on Chicago PMI and Personal spending data from the US

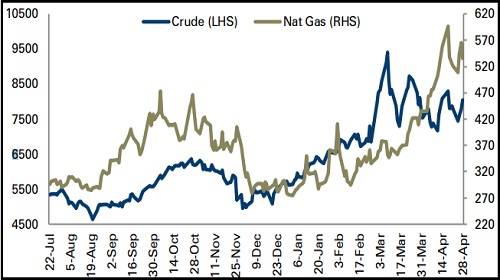

Energy Outlook

• WTI crude oil prices advanced more than 3.0% on Thursday after reports that Germany is prepared to ban on Russian oil, which could further tighten oil supplies

• Opec and allies led by Russia is expected to maintain its modest pace of increasing output when it meets on May 5

• US natural gas prices slipped almost 5.0% on Thursday after the US EIA reported that utilities added 40 billion cubic feet (bcf) of gas to storage during the week ended April 22

• MCX crude oil prices are expected to trade with a positive bias due to worries over lower oil supply from Russia. MCX crude oil prices are trading above the key support levels of 50 day moving average, which is at | 7,850. As long as it sustains above this level, it is likely to retest | 8,300 levels for the day. Additionally, investors will keep focus on rig counts data from the US

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">