MCX crude oil price is facing resistance at mean +2 sigma levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

https://t.me/InvestmentGuruIndiacom

Download Telegram App before Joining the Channel

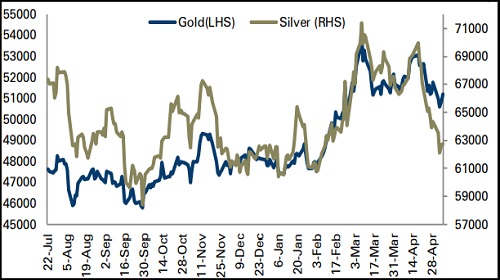

Bullion Outlook

• Comex gold prices surged around 0.40% on Friday amid risk aversion in the global markets

• Moreover, ongoing geopolitical tensions between Western nations and Russia lifted demand for precious metals

• However, better than expected Nonfarm payrolls data from the US restricted further gains in bullions prices. Nonfarm payrolls rose by 428,000 jobs in April 2022 compared to forecast level of 391,000, US Labor Department said on Friday

• MCX gold prices are expected to rise towards | 51,750 for the day due to pessimistic sentiments in global markets and worries over higher inflation. However, prospects of aggressive monetary policy tightening from the US Federal Reserve will continue to pressurise bullion prices on higher side. Silver prices are expected to take cues from gold prices and may rally towards | 63,500 levels for the day

MCX Gold vs Silver Performance

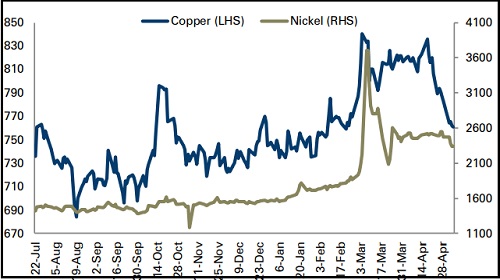

Base Metal Outlook

• LME Copper prices slipped 0.70% on Friday as investors expressed concerns over rising US interest rates could hurt global economic outlook

• Further, copper prices remained under pressure due to significant increase in inventories. LME registered warehouse inventories of copper increased to 170,775 tonnes from 156,050 tonnes over the last week, highest since Oct 2021

• Moreover, CFTC data showed that large speculators increased their net short positions in Comex copper to 15,600 contracts from 3,800 contracts, indicating the bearish sentiment

• MCX copper prices are expected to consolidate in the range of 200 day moving average (| 755) and 100 day moving average (| 779) in the coming sessions

MCX Copper vs. Nickel Performance

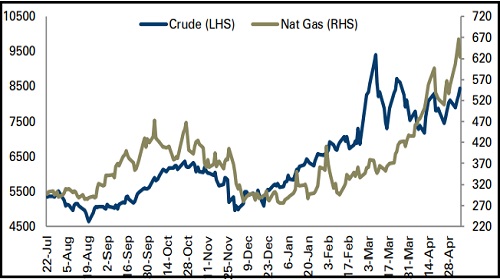

Energy Outlook

• WTI crude oil prices rallied more than 2.0% on concerns about tight supply as impending European Union sanctions on Russian oil

• On the demand side, investors expect higher demand from the United States this autumn as Washington unveiled plans to buy 60 million barrels of crude to refill emergency stockpiles

• However, Saudi Arabia's has reduced its June official selling price (OSP) to Asia for its Arab Light crude to $4.40 from $9.35, which has continued to pressurise oil prices on higher side

• As per the Baker Hughes report, US oil rigs count increased to 557 from 552 over the last week, their highest since April 2020

• MCX crude oil price is facing resistance at mean +2 sigma levels of | 8,525. As long as it sustains below this level, it is likely to correct towards | 8,200 for the day

MCX Crude Oil vs. Natural Gas Performance

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer