MCX copper prices are expected to correct further towards 748 levels for the day - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• MCX gold prices eased around 0.25% on Wednesday amid a stronger dollar index. US dollar index surged after Fed Chair Jerome Powell signalled a aggressive monetary policy tightening in upcoming meeting to combat the elevated inflation

• Further, continuous outflows from SPDR Gold ETF funds over the last week, indicate bearish sentiments in the market

• However, sharp downsides were limited due to retreat in US 10 year bond yields and pessimistic sentiments in global markets

• MCX gold prices are expected to `consolidate in a range of | 50,400 to | 49,900 in the coming days. Silver prices are expected to take cues from gold prices and trade in the range of | 60,300 to | 61,300 for the day. Additionally, investors will remain cautious ahead of initial jobless claims data from the US

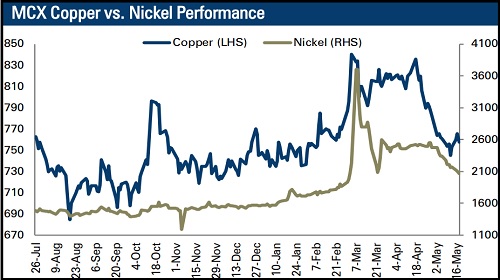

Base Metal Outlook

• LME Copper and aluminium prices retreated on Wednesday amid a stronger dollar index and on unsatisfactory macroeconomic data from the US

• US building permits declined to 1.819 million units in April 2022 compared to 1.879 million units in the previous month, lowest level since November 2021 due to increasing mortgage rates, elevated building material cost and supply chain constraints

• Moreover, a significant increase in inventories weighed on copper prices. LME registered warehouse stockpiles of copper surged to 180,925 tonnes from 175,875 tonnes over the last week

• MCX copper prices are expected to correct further towards | 748 levels for the day on expectations of disappointing existing home sales data from the US

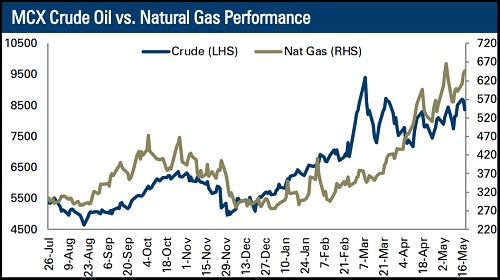

Energy Outlook

• WTI crude oil prices slipped 2.75% on Wednesday after government data showed US refiners ramped up output, easing worries of a supply crunch

• Further, oil prices remained under pressure amid the US planning to relax sanctions against Venezuela and allow Chevron Corp to negotiate oil licenses with state producer PDVSA

• However, expectations of further lockdown easing in China along with decline in US crude oil stockpiles restricted further downsides in oil prices. US commercial crude inventories slipped to 420.80 million barrels from 424.20 million barrels over the past one week

• MCX crude oil (June Futures) price is trading below the key support at mean +2 sigma ( | 8,670). As long as it sustains below this level, it is likely to correct towards mean levels of | 8,030 in the coming days

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

More News

Sell on rise is recommended near 51400 for tgt of 51000 and stoploss of 51550 - Tradebulls ...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">