MCX Copper and other industrial metal prices rallied on Thursday amid easing concerns over demand outlook - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

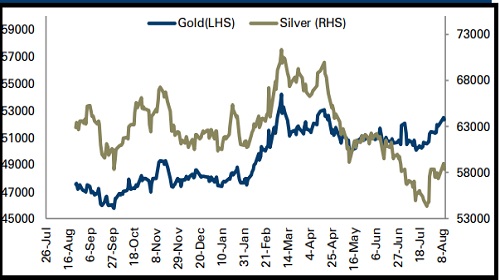

Bullion Outlook

* Comex gold prices eased almost 0.50% on Thursday, weighed down by hawkish policy remarks by US Federal Reserve officials even as data pointed to signs of inflation peaking

* Further, improved macroeconomic data from the US continued to pressurised precious metal prices. The number of Americans filing new claims for unemployment benefits increased to 262,000 from 248,000 for the week ended 07 July 2022

* However, continues decline in US dollar index restricted further downsides in bullion prices

* MCX gold prices are expected to trade with a negative bias for the day due to rising US 10 year bond yields. It is likely to get dragged down towards | 52,000 for the day

* Further, silver prices are expected to take cues from gold prices and may move towards | 57,500 levels in coming sessions

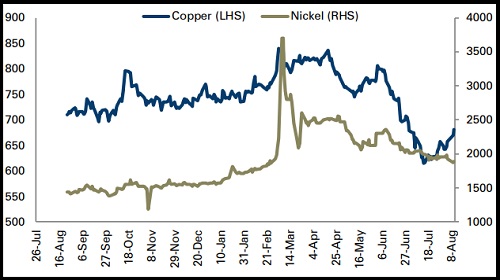

Base Metal Outlook

* MCX Copper and other industrial metal prices rallied on Thursday amid easing concerns over demand outlook

* Additionally, China’s copper imports surged to 463,693 tonnes in July, compared with 424,280.3 tonnes a year earlier as the sharp drop in prices triggered buying

* However, a sharp increase in LME copper inventories capped further gains in copper prices. LME registered warehouse inventories of copper surged to 131,575 tonnes from 128,600 tonnes over last week

* MCX copper prices are expected to move towards | 690 for the day on expectations of further easy monetary policy from China and weakness in US dollar index

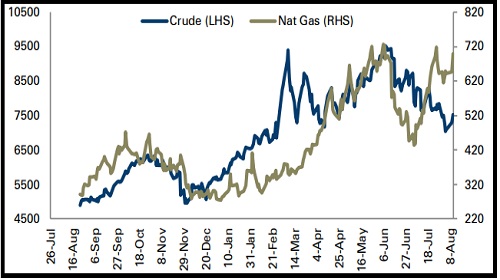

Energy Outlook

* WTI crude oil prices gained almost 3.25% on Thursday after the International Energy Agency raised its oil demand growth forecast for this year as soaring gas prices drive some consumers to switch to oil

* Additionally, Russia’s oil output is set to fall roughly 20% by the start of next year as a European Union import ban comes into force, according to the International Energy Agency

* However, Opec expects 2022 oil demand to rise by 3.1 million bpd, down 260,000 bpd from the previous forecas

* US natural gas futures surged more than 8.0% on Thursday amid forecasts of higher cooling demand in the next two weeks than previously expected

* MCX natural gas prices are expected to rally towards | 710 for the day due to higher demand from the US and on concerns over global supply tightness

To Read Complete Report & Disclaimer Click Here

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

Above views are of the author and not of the website kindly read disclaimer

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">