MCX Copper and other industrial metal prices eased on Thursday after the US Federal Reserve hiked interest rates - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Comex gold prices advanced more than 1.50% on Thursday amid a weaker dollar index and on disappointing macro economic data from the US.

• The number of Americans filing new claims for unemployment benefits increased to 229,000 compared to forecasts level of 215,000 for the week ended 11 June 2022

• Moreover, a sharp decline in 10 year treasury yields along with risk aversion in the global markets continued to support the precious metal prices on lower side

• MCX Gold price is trading above the mean levels of | 50,920. As long as it sustains above this level, it is likely to rally towards mean +2 sigma levels of | 51,500 in the coming days. Silver prices are expected to take cues from gold prices and may move towards | 62,750 levels for the day. Additionally, investors will remain cautious ahead of US Fed Chair Powell speech

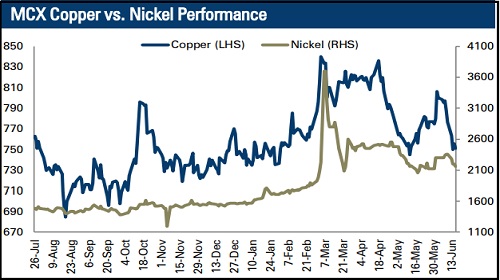

Base Metal Outlook

• MCX Copper and other industrial metal prices eased on Thursday after the US Federal Reserve hiked interest rates highlighted the deteriorating outlook for industrial metal demand.

• Further, unsatisfactory building permits data from the US weighed on base metal prices. US building permits dropped to 1.695 million units in May 2022 compared to 1.823 million units in the previous month primarily due to soaring mortgage rates

• However, consistent decline in LME inventories along with weakness in dollar index restricted further downsides in industrial metal prices.

• MCX Copper prices are likely to slip towards | 735 levels for the day on expectation of disappointing industrial production data from the US and concerns over slow down in global economic growth.

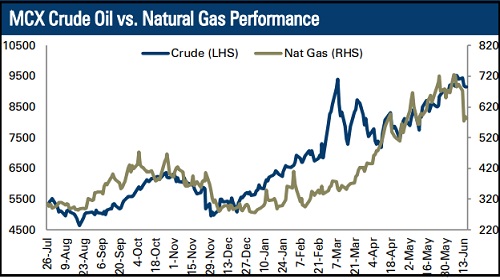

Energy Outlook

• WTI crude oil prices rebounded more than 1.70% on Thursday after the United States announced new sanctions on Iran

• At the same time, oil prices have been supported by lower oil output from Libya along with rising summer season fuel demand from the US.

• The IEA said it expects demand to rise further in 2023, growing by more than 2% to a record 101.60 million bpd.

• However, The market slipped early, as interest rate hikes in the United States, Britain and Switzerland fed concerns about global economic growth.

• MCX crude oil prices (July Futures) are expected to trade in the consolidation range of | 8,850 to | 9,350 for the day on hopes of higher rig counts data from the US. However, worries over tight supply will continue to support the oil prices on lower side

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer