MCX Aluminium prices are expected to rally towards 226 levels - ICICI Direct

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Bullion Outlook

• Comex gold prices surged more than 1.50% on Wednesday amid a retreat in US 10 year bond yields and on weakness in dollar index.

• At the same time, unsatisfactory macro economic data from the US boosted demand for safe heaven assets

• However, aggressive monetary policy tightening by US Fed capped further gains in bullion prices. US Federal Reserve raised its key benchmark interest rate to 1.75% from 1.0%, the biggest rate hike since 1994

• MCX gold prices are expected to rise further towards | 51,000 for the day primarily due to easing dollar index. Silver prices are expected to take cues from gold prices and may rally towards | 62,500 levels for the day. Additionally, investors will keep an eye on initial jobless claims data from the US

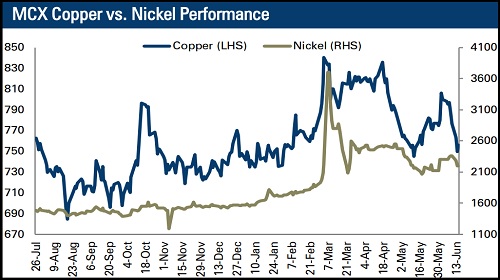

Base Metal Outlook

• MCX aluminium and other industrial metal prices advanced on Wednesday amid a better-than-expected economic data from China

• China's economy showed signs of recovery in May after slumping in the prior month as industrial production rose unexpectedly, while car sales jumped 54% in the week of June 6 versus the same period in May

• China's monthly production of aluminum has improved in May month following easing in power consumption curbs and as COVID-19- induced lockdowns had little impact on output.

• MCX Aluminium prices are expected to rally towards | 226 levels for the day due to significant decline in LME inventories. Additionally, inventors will remain cautious ahead of building permits data from the US

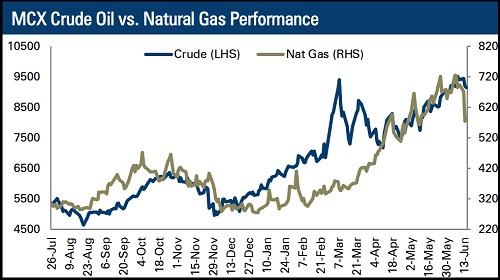

Energy Outlook

• WTI crude oil prices declined almost 2.0% on concerns over fuel demand and sharp decline in US crude oil stockpiles.

• According to EIA data showed, US commercial crude inventories surged to 418.70 million barrels from 416.75 million barrels over the past one week

• Higher oil prices and weakening economic forecasts are dimming futures demand prospects, the International Energy Agency said on Wednesday.

• US natural gas futures rose more than 4.0% after Russian monopoly Gazprom halted gas supplies to Germany.

• MCX natural gas prices are expected to rally towards | 620 for the day on expectation of fall in natural gas storage level from the US and lower gas flows to European countries from Russia.

To Read Complete Report & Disclaimer Click Here

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

Above views are of the author and not of the website kindly read disclaimer