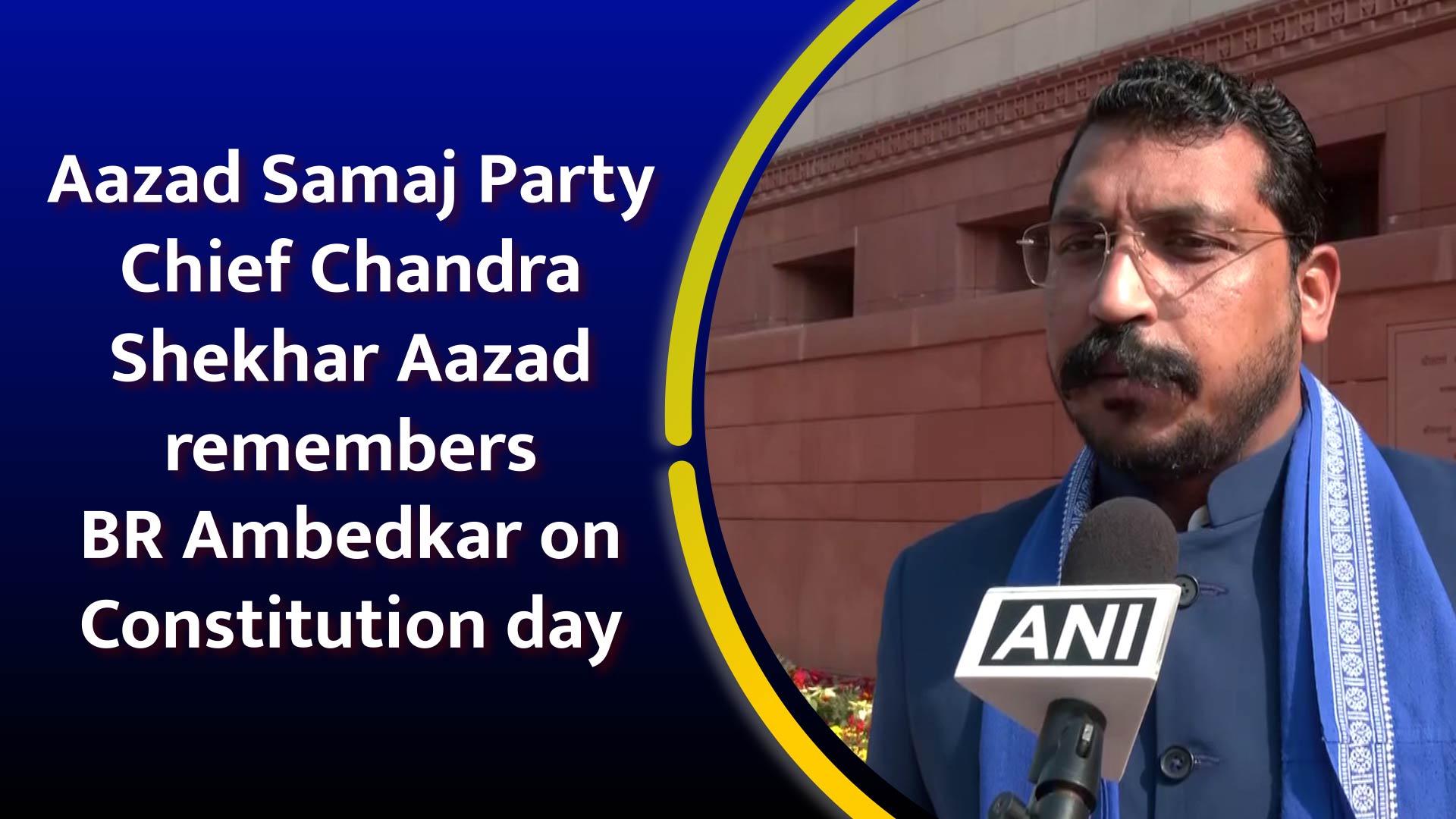

Large Cap : Buy GAIL (India) Limited For Target Rs.156 - Geojit Financial

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Strong quarter; Positive Outlook

GAIL India is a Government of India undertaking. The company processes and distributes natural gas and liquefied petroleum.

• Revenue grew 73.4% YoY (+4.6% QoQ) in Q4FY22 aided by good performance across Trading segment slightly offset by petrochemical business.

• EBITDA margin fell 120bps YoY to 15.3% due to lower transmission and LPG earnings. PAT grew 40.6% YoY to Rs. 2,683cr in Q4FY22.

• GAIL declared Final divided of Rs. 10/share for FY22.

• GAIL is expected to continue delivering positive growth in near term owing to rising prices, capex prospects and surging demand from the fertilizer plants, refinery and petrochemical expansions. Hence, we reiterate our BUY rating on the stock with a revised target price of Rs. 156 based on SOTP valuation methodology

Trading gains led the revenue growth

In Q4FY22, standalone revenue went up to 73.4% YoY to Rs. 26,968cr (+4.6% QoQ), owing to higher revenue across natural gas marketing, LPG transmission and trading segment due to increased prices owing to global war tensions which was offset by weak performance in the petrochemicals business. EBITDA went up to Rs. 4,138cr in Q4FY22 (+61.3% YoY, -2.1% QoQ) aided by higher realizations alongside improved operational efficiencies whereas EBITDA margin fell 120bps YoY to 15.3%. Consequently, PAT for the quarter grew 40.6% YoY to Rs. 2,683cr (-18.4% QoQ).

Key concall highlights

• Estimated capex is ~Rs. 75bn for FY23, the company shall invest in various projects worth ~Rs 300bn, over the next 3 years.

• GAIL has Successfully obtained approval from Competition Commission of India (CCI) for acquiring IL&FS Group’s 26% equity in ONGC Tripura Power Company (OTPC) and completed acquisition of IL&FS Group’s 26% equity in OTPC on April,1 2022.

• Management has retired high cost loan by exercising call option on Bond Series 2015 which was issued at 8.30% p.a. and an amount of Rs. 500cr has been paid.

• GAIL Board approved buyback of ~5.70cr shares at Rs. 190/share aggregating to ~Rs. 1,083cr in FY 2021-22.

Gail undertakes Green Energy capacity expansion

GAIL shall invest Rs. 26,000cr in the renewable’s portfolio by 2030 out of which Rs. 6,000cr will be invested in 3 years, and ~Rs. 20,000cr by 2030. It is looking forward to 1 GW of renewable capacity over the next 3 years. This shall consolidate to 10% of GAIL's portfolio to be hydrogen plus renewable by 2030 which shall expand portfolio of the company and reap benefits.

Valuation

GAIL shall benefit from the capex prospects, enhanced utilization of Urja Ganga pipeline and expansion of Petrochemical pipelines, which shall aid increased demand and improve profitability. Economic revival along with increased prices and green capacity plant shall act in favor of the company’s profit margins. Maintaining a positive outlook, we reiterate our BUY rating on the stock with a rolled forward target price of Rs. 156 based on our SOTP methodology.

To Read Complete Report & Disclaimer Click Here

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345

Views express by all participants are for information & academic purpose only. Kindly read disclaimer before referring below views. Click Here For Disclaimer