Kotak Mahindra Mutual Fund Launches Kotak ESG Opportunities Fund

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Below are Views On Kotak Mahindra Mutual Fund Launches Kotak ESG Opportunities Fund

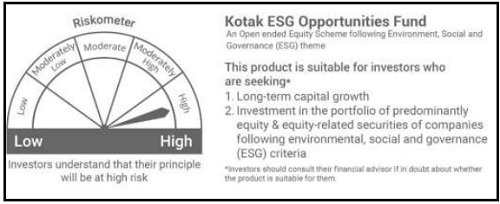

Mumbai, 19th November, 2020: Kotak Mahindra Asset Management Company Limited (KMAMC) today announced the launch of ‘Kotak ESG Opportunities Fund’, which will focus on Environmental, Social and Governance (ESG) factors and the Principles for Responsible Investing (PRI). The New Fund Offering (NFO) opens for subscription on 20th November, 2020 and closes on 4 th December, 2020.

KMAMC is the first asset management company to sign the United Nation's Principles for Responsible Investment (UNPRI), leading the narrative of responsible investing in India. Taking ahead its philosophy of delivering optimum returns on a sustainable basis for its investors, the Kotak ESG Opportunities Fund, which will be managed by Harsha Upadhyaya, will invest in companies based on financial parameters and non-financial factors such as Environmental, Social and Governance as a part of its research process to identify material risks and growth opportunities.

To assess ESG performance of an investee company, broadly, Kotak ESG Opportunities Fund will look at policies, practices and disclosures of each ESG pillar i.e. for environmental performance, it will be energy efficiency measures, waste management including e-waste management, carbon & greenhouse gas (GHG) emission footprint, and renewable energy use; for social performance it will be employee working conditions, welfare & training, and health & safety standards; and for assessing governance performance, in addition to corporate governance practices and disclosures as required under the Companies Act, 2013 and SEBI’s (LODR) 2015, it will be whistle-blower and anti-corruption policy, no child labour policy, anti-sexual harassment policy, diversity and inclusivity policies and practices etc.

Harsha Upadhyaya, CIO – Equity & President, Kotak Mahindra Asset Management Company Limited said, “Globally, investors are increasingly evaluating Environmental, Social and Governance (ESG) performance and disclosures. Put simply, performance of all three bottom-lines – Profit, Planet (environment) and People (social) are equally important as against looking at only the Profit bottomlines few years back. ESG investment principles look even at ‘how companies make money’ and not just at ‘how much money the company makes’. Kotak ESG Opportunities Fund will focus on the ESG principles and disclosures of the investee company with the flexibility of investing across market capitalisation range with the aim to create sustainable wealth for our investors.”

KMAMC will use Sustainalytics ESG Risk Ratings – a leading global provider of ESG research, ratings and data - to support its Kotak ESG Opportunities Fund.

Above views are of the author and not of the website kindly read disclaimer

Tag News

We anticipate immense potential benefits from the upcoming Sovereign Gold Bond Tranche in FY...

320-x-100_uti_gold.jpg" alt="Advertisement">

320-x-100_uti_gold.jpg" alt="Advertisement">